Appraiser Update June 2024

Welcome to our June 2024 Fannie Mae Appraiser Update.

In this edition, we cover a range of topics including your rights and responsibilities under the recently published reconsideration of value framework, avoiding and fixing appraisal deficiencies that could result in letters to the relevant state regulatory agency, and when to use Form 1007 in determining market rent for a single-family property. We have refreshed the look and feel of our newsletter. We hope you like it!

Please use the Contact Us link at the end of this newsletter to tell us what you think of the new layout and what you would want to read about in future newsletters.

Collateral Policy Team

Fannie Mae

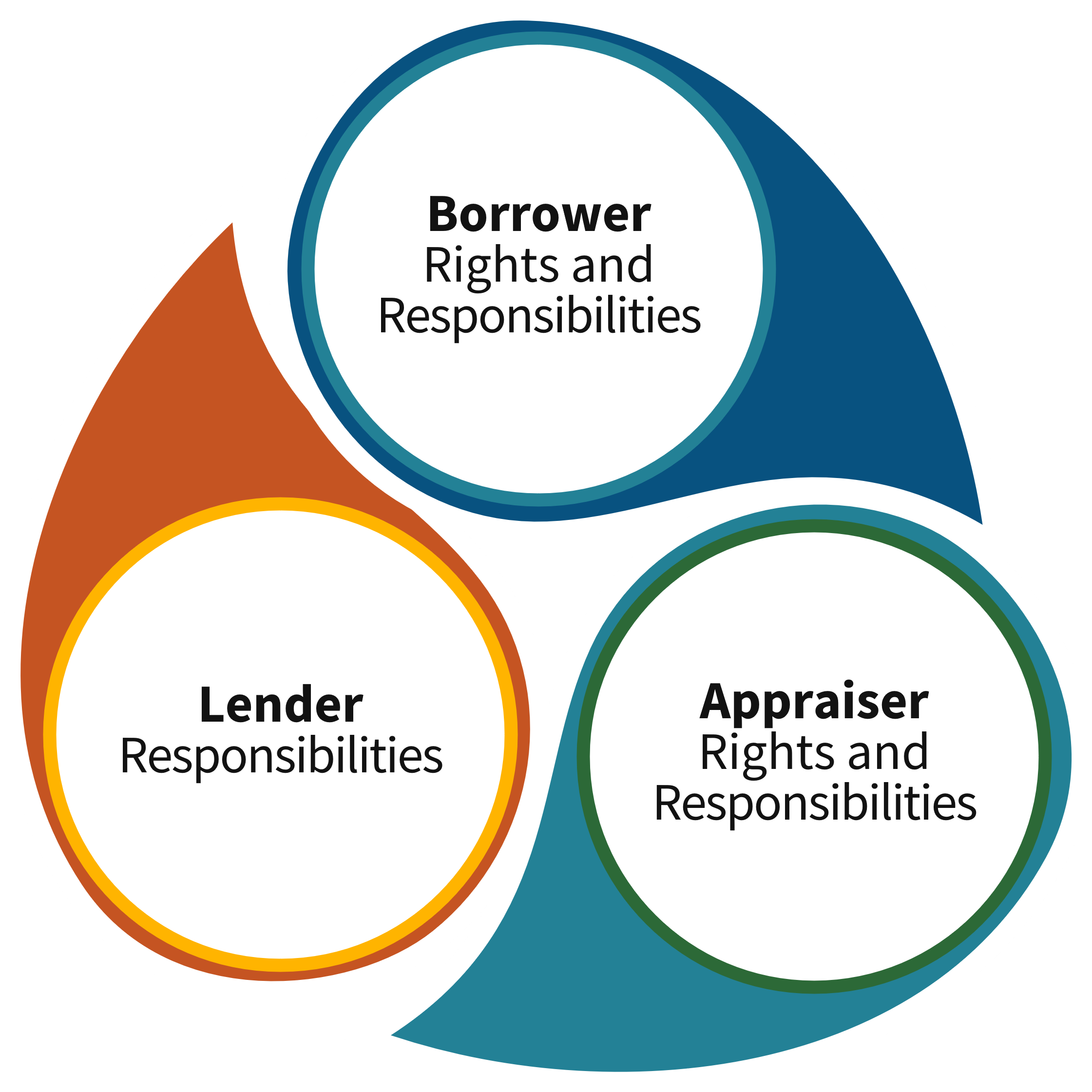

Reconsideration of value — rights and responsibilities

On May 1, 2024, Fannie Mae published a new reconsideration of value (ROV) policy, which standardizes elements that must be part of a lender’s borrower-initiated ROV policies and procedures. It formalizes a framework for borrowers to appeal an appraisal on their own behalf. This policy is designed to create a balanced approach for informing borrowers of their rights and responsibilities while maintaining appraiser independence and standardizing operations for lenders. Requests for an ROV are not new to the industry, with each lender historically having their own policies. However, the lack of standardization can be confusing for borrowers.

Lender responsibilities

Lenders will provide a disclosure to borrowers outlining the ROV process including submission requirements at the time of the loan application and again when the appraisal report is provided to the borrower. Lenders must complete their appraisal review before initiating the ROV process, designate an underwriter or other appraisal subject matter expert to review any ROV requests, and validate that the request from the borrower contains sufficient supporting evidence prior to sending to the appraiser. If the borrower’s request for an ROV is validated, the lender must send a standardized communication to the appraiser that contains all of the following:

- Borrower(s) name, property address, effective date of the appraisal, appraiser name, and date of the ROV

- Identification and description of unsupported, inaccurate, or deficient areas in the appraisal report

- Additional data, information, or comparable properties, not to exceed the maximum of five

- A definition of turn-time expectations for communicating ROV results

- Instructions for delivering the ROV response as part of a revised appraisal report that includes commentary on conclusions regardless of the outcome

- A reference for appraisers on how to correct minor appraisal issues or nonmaterial errors not related to the ROV process

Lenders are also required to report unresolved material deficiencies or evidence of unacceptable appraisal practices to the appropriate appraisal licensing agency or regulatory board and to report suspected overt violations of anti-discrimination laws to the proper local, state, or federal agency.

A best practice for lenders is to include the definition of turn-time expectations for possible ROVs in the initial appraisal engagement letter. Regardless, all of the lenders’ ROV policies and procedures must be aligned with Appraiser Independence Requirements (AIR).

For any appraisal, only one borrower-initiated ROV is permitted. The ROV must be submitted by the borrower to the lender before loan closing. After a loan has closed, an ROV request is no longer allowed to be submitted by the borrower for that appraisal.

Borrower responsibilities

The borrower must provide supporting information that identifies and describes what they consider to be unsupported, inaccurate, or deficient items along with additional data, information, and up to five comparable sales (and the related data sources), with an explanation of how the new data supports the ROV.

For any appraisal, only one borrower-initiated ROV is permitted. The ROV must be submitted by the borrower to the lender before loan closing. After a loan has closed, an ROV request is no longer allowed to be submitted by the borrower for that appraisal.

Appraiser responsibilities

After receiving the request from the lender, the appraiser must analyze the relevance of the information provided with the ROV. Regardless of whether the ROV request results in a change in value or not, a revised appraisal must be provided within the defined time frame with a description of the points in dispute and the outcome.

Appraiser rights

This policy aims to protect appraisers’ rights through two mechanisms: First, ROV requests must meet minimum information requirements and be deemed relevant to support the dispute by the lender’s validation process. It limits the number of alternative comparables that can be shared with the appraiser to five. Also, it limits the borrower to one ROV request per appraisal. Second, it makes clear that the ROV policy in no way supersedes or changes our AIR.

The standardized ROV policy is in place to educate borrowers about their right to appeal an appraisal on their own behalf and how to do it, while creating uniform expectations on how to manage ROVs and maintaining appraiser independence. Transparency in the work performed during this process will increase lender confidence that they are receiving high-quality appraisal reports and will increase public trust in the appraisal profession.

The article “How State Tips Work” in the September 2023 Appraiser Update describes how Fannie Mae’s post-acquisition quality control process identifies appraisal defects. Of course, appraisers would like to avoid defects and other disputes such as ROV requests related to their appraisals. One way to do so is to incorporate detailed, factual analysis supported by market data into the appraisal report with the goal of helping the reader to understand how the appraiser derived the value estimate. Here are some examples of appraisal defects we’ve found recently along with ideas on how data-centric analysis could have helped avoid the deficiency:

- Issue: The appraisal report stated that no adjustments are required for differences between lake frontage and golf course frontage, noting that the market accepts these locations as equal.

Suggestion: Present paired sales demonstrating these locations are similar in value.

- Issue: The appraisal relies on an adjustment for design, stating the subject’s design commands a premium. The appraisal includes no recent sales of similar design.

Suggestion: Include older sales of equal design that demonstrate the impact on price. - Issue: The appraisal includes sales from outside the subdivision, noting that all recent sales from the subject’s subdivision were deemed unsuitable to be used as comparables.

Suggestion: Support the statement with detailed explanations of why they were unsuitable. Also, provide an analysis showing any difference in pricing due to location and adjust accordingly.

An opinion of value, like any opinion, is strengthened by supporting data and explanations of conclusions. Make a practice of providing this kind of information in every appraisal report to help avoid questions later.

Short-term rentals and Form 1007

Recently, Fannie Mae has received many questions about the Single-Family Comparable Rent Schedule (Form 1007). It enables the appraiser to document the estimation of monthly market rent for the subject property when completing an appraisal on a single-family investment property for conventional lending. It can also be used for condominium investment properties.

The Selling Guide allows lenders to use rental income for qualifying purposes under certain circumstances. Form 1007 is only required when rental income is used to qualify, and the subject is a one-unit investment property. The lender may also use the 1007 as the basis for reporting gross monthly rent at loan delivery. (See “Reporting of Gross Monthly Rent” in B3-3.1-08, Rental Income.) For refinances, the 1007 is used in combination with either tax returns or lease agreements, while for purchases, the 1007 may be used in combination with lease agreements or as a stand-alone.

One question we often hear is whether the 1007 should be used for short-term rentals (STRs). The Selling Guide is silent on whether an STR should be considered rental income. STRs differ from longer-term leases in several ways. The most obvious is the length of the agreement: STRs are typically executed on a nightly basis, similar to a hotel, while residential leases are typically structured on a monthly basis. Also, STRs typically involve not only usage of the real property but also personal property, such as furniture, fixtures, and equipment (FFE). STRs are typically executed with a terms and conditions agreement, not a lease agreement. The STR may include additional services such as food or housekeeping.

Note: When appraising an STR for conventional mortgage lending, the appraiser must take care to only include the real property in the value, not the personal property or the business/going concern.

In light of these differences, it may make the most sense to think of an STR as a going concern and the income as business income rather than rental income. But, under our current policy, the decision of how to categorize the STR income is up to the lender. If the lender chooses to treat STR income as business income, then Selling Guide provisions for underwriting business income would apply, and the lender would not need a 1007. Conversely, if the lender chooses to treat it as rental income for qualifying purposes, then the lender must obtain Form 1007 where specified by the Selling Guide.

The 1007 was not designed for appraising single-family properties that are used as STRs. Specifically, the 1007 calls for the “Indicated Monthly Market Rent.” This means the appraiser needs to analyze competing properties leased on a monthly basis. It would be incorrect for the appraiser to use STR comparables and then multiply the nightly STR fee by 30 to estimate a monthly rent. Such an approach would fail to account for FFE, other services, vacancy rates, and business expenses.

In summary, while a lender may choose to request a 1007 for an appraisal of an STR, in fulfilling the assignment the appraiser must use rental comparables with monthly lease rates to support the “Indicated Monthly Market Rent.” Alternative definitions and methodologies are not acceptable. Form 1007 cannot be used to estimate the nightly fee for an STR.