RefiNow: Expanding refinance eligibility for qualifying homeowners

RefiNow™ is an affordable refinancing option aimed at making it easier and less expensive for qualifying homeowners to refinance. Available to borrowers at or below 100% of the area median income with debt-to-income (DTI) ratios up to 65%, RefiNow offers features that help to address some of the barriers to refinance and is a great option for creditworthy borrowers who may not have previously qualified.

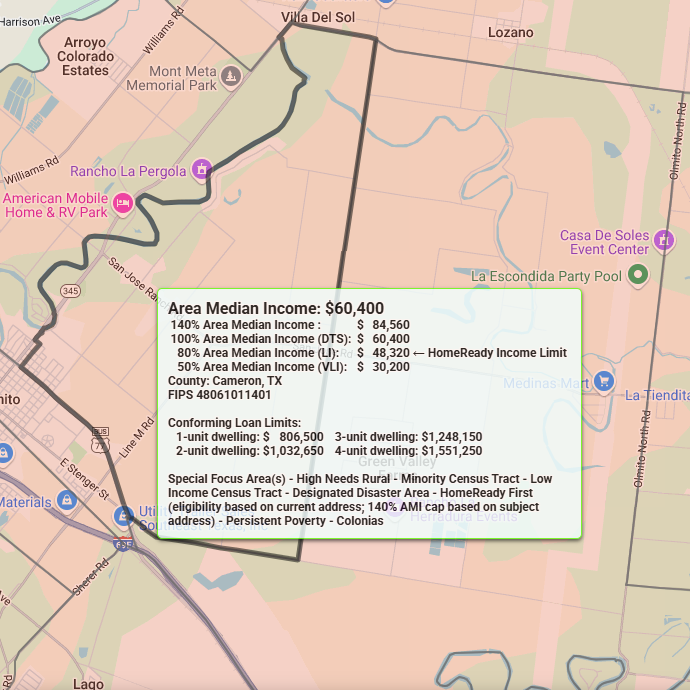

The 2025 area median incomes (AMIs) have been implemented in Desktop Underwriter®(DU®), Loan Delivery, and the Area Median Income Lookup Tool. At a FIPS-level, 93.1% of AMIs increased for 2025, meaning more borrowers may meet AMI requirements.

Find new opportunities

Find new opportunities for more borrowers with a refinance option now available to homeowners with a DTI up to 65% and no minimum credit score requirement.

Make homeownership more sustainable

With interest rates required to be reduced by a minimum of 50 bps, and a reduction to the monthly mortgage payment required, RefiNow can help make homeownership more sustainable in your community.

Address up-front costs

The availability of a value acceptance offer or a $500 credit* helps borrowers address up-front costs.

To qualify for the refinance option, homeowners must have:

- a Fannie Mae owned mortgage secured by a 1-unit, principal residence;

- current income at or below 100% of the area median income;

- no missed payments on their current mortgage loan in the past six months, and no more than one missed payment in the past 12 months; and

- a mortgage with a loan-to-value ratio up to 97% and a debt-to-income ratio of 65% or less (applies to the new refinance loan).

*Credit will be provided in the form of a $500 LLPA credit to the lender at the time the loan is purchased if an appraisal was obtained for the transaction. The lender must pass the credit on to the borrower.

Fannie Mae’s expects lenders to help borrowers understand the benefit of RefiNow and the total cost of the refinance over the life of the loan. You may find it useful to use FannieMae.com consumer website to support your conversations.

Area Median Income Lookup Tool

Use the interactive map to quickly look up income eligibility by area, property address or Federal Information Processing Standards (FIPS) code.

For Area Median Income Lookup Tool Tips click here.

You can also download Income Eligibility by county (excel).