What is an eMortgage?

An eMortgage is a mortgage where the promissory note and other key documents are created, signed, and stored electronically, reducing reliance on traditional paper processes.

Use the buttons below to quickly navigate to content aligned with where you are in your journey.

Already delivering eNotes and need help? Find the answers you need in the Learning Center.

Move past

yesterday's lending

Save time and simplify the experience for yourself and your borrowers.

Faster funding

Lenders can save up to 5 days in cycle time reduction with eNotes vs. Paper Notes.1

Fewer errors

Reduce human errors associated with generating, reviewing, and managing paper closing documents.

Accessible anywhere

Borrowers can receive and review their loan documents from anywhere in the world.

Convenient closing

With remote online notarization (RON) borrowers don’t have to coordinate closing around their busy schedule.

Learn key eMortgage terms

Don't just take our word for it

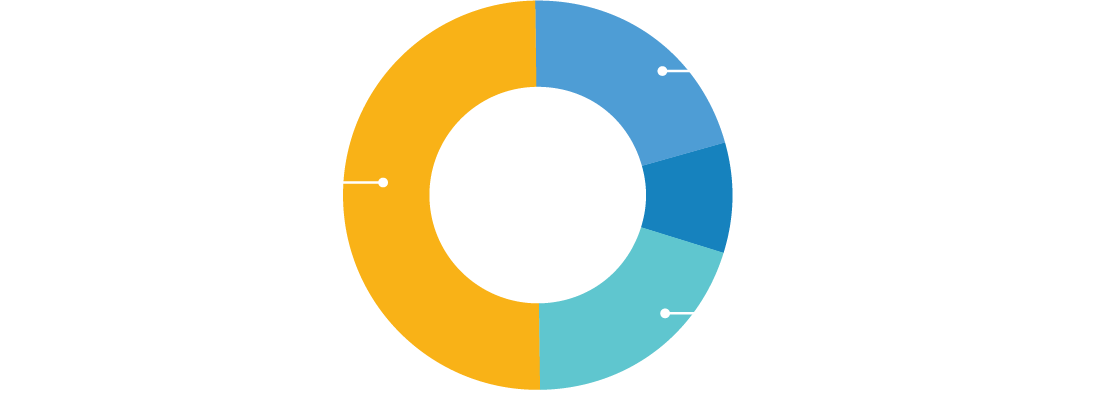

According to the Mortgage Lender Sentiment Survey2, 62% of lenders plan to use eNotes in the next two years.

Top perceived benefits of eNote adoption:

- Improved operational efficiency

- Enhanced borrower experience

See how New American Funding (NAF) gets the most out of going digital.

Switch to eMortgage.

Stay ahead of the game.

The data doesn't lie – reduce Closing to Funding timelines with eNotes.

Average cycle time reduction in days among sellers who use eNotes to deliver more than 25% of their loans to Fannie Mae:

Total average cycle time reduction of ~5 days¹

Some sellers even reduced their cycle time by more than 10+ days

Let's demystify eMortgages

What does going digital really mean?

Myth or Fact

Fannie Mae requires the Note to be signed on the day of closing.

Myth! Fannie Mae does not require specific timing for document execution but requires that the "NOTE DATE" matches the date on the Security Instrument.

Myth or Fact

I'm not allowed to mix eNotes with paper Notes.

Myth! Fannie Mae has no restrictions on commingling eNotes and paper notes, and both can benefit from auto-certification.

Myth or Fact

My custodian is not ready for eNotes.

Myth! Your custodian is not required to have an eVault. Sellers deliver eNotes directly to Fannie Mae’s eVault.

Sign and secure the eNote

- Electronically sign the eNote (and any related documents) using an eClosing system.

- The eClosing system's tamper seal protects your documents.

- Register your eNote on the MERS eRegistry within one business day.

Transmit your eNote

Use MERS eDelivery to send the eNote and other needed documents (like a certified POA if used) straight to Fannie Mae's eVault.

Transfer control

Through the MERS eRegistry, hand over Control & Location of the eNote.3

Finalize and fund

Submit all loan delivery info, including the eNote Indicator, and once everything checks out, the loan is certified and funded.

Make the move today

Investigate

Learn how you can save time and money, reduce risk, and provide a better experience for borrowers and settlement providers. Discover best practices for transitioning.

Select partners

Choose the right eMortgage partners including technology service providers, servicers and sub-servicers, and warehouse banks. Find support today by searching a list of partners.

-

Implement

Work closely with your partners and Fannie Mae to finalize the implementation process.

-

Deliver

Ramp up your eMortgage program and provide an exceptional customer experience.

References

1The information presented above is based on data collected from April 1, 2024 to June 30, 2024 reflecting the aggregated response of lenders who deliver more than 25% of loans as eNotes to Fannie Mae. The results are not representative of all lenders delivering eNotes to Fannie Mae. The information is intended to provide general insights and should not be interpreted as a promise or guarantee of specific outcomes. Fannie Mae makes no representations or warranties of any kind about the completeness, accuracy, or suitability with respect to the information provided.

2Fannie Mae Mortgage Lender Sentiment Survey® August 2025.

3C1-2-04, Delivering eMortgages to Fannie Mae