My web

Entering a Best Efforts Loan Using “Other” Underwriting Method

![]()

Introduction

This job aid explains the steps needed to enter the details of a new best efforts loan into the Pricing & Execution - Whole Loans® (PE – Whole Loan) application when you are using the "Other" underwriting method. For information on entering a loan using an eligible Desktop Underwriter® (DU®) Casefile ID, see the Entering a Best Efforts Loan Using a DU Casefile ID job aid.

The “Other” underwriting method does not require a DU Casefile ID at time of the commitment. A seller may select the “Other” underwriting method when committing loans that have been underwritten either manually or by an alternative underwriting system; or if the seller does not have an Approve/Eligible DU recommendation prior to commitment. There may be an adjustment to the commitment price if the "Other" underwriting method is selected.

Note: You may change the underwriting method at any time prior to committing. However once a loan is committed, the underwriting method may not be updated. Contact the Capital Markets Sales Desk (1-800-752-0257) with any questions pertaining to changes in underwriting methods post committing.

Entering Your New Commitment and Loan Details Information

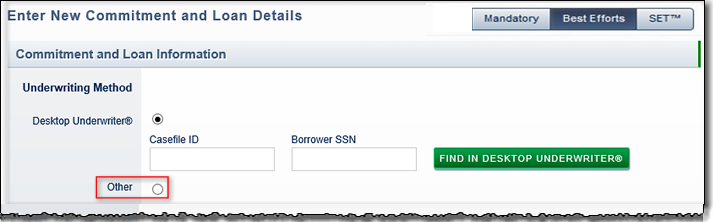

To add or commit a loan using the "Other" Underwriting Method follow the steps below:

-

Open the Enter New Commitment and Loan Details screen. See Accessing the Enter New Loan Details Screen.

-

Select the Other radio button as the Underwriting Method.

Note: Once Other is selected, the Find in Desktop Underwriter button and Casefile ID field disappear. The PE– Whole Loan application will assign a system generated Casefile ID at the time of commitment.

Complete the remaining fields in the Commitment and Loan Information section as follows:

|

Field Name |

Description/Instructions |

|

Seller Unique ID |

Enter the loan’s unique loan number or identifier (e.g. lender loan number or borrower name). |

|

Product Name |

Enter a few characters of the product name (e.g., 30-year) and a drop-down list of available Fannie Mae loan products will appear. You can select the loan product from this list. |

|

Gross Note Rate |

Enter the note rate (the rate paid by the borrower) of the loan, including servicing fees. |

|

Gross Margin (%) |

Field that appears for ARM products only. The amount that is added to an index value to create the mortgage interest rate for an ARM at adjustment. |

|

Loan Amount |

Enter the amount of the loan. |

|

Commitment Period (days) |

Position your cursor in either the Commitment Period (days) or Commitment Expiration Date field. Select a commitment expiration date from the calendar. The commitment expiration date must be a Fannie Mae business day. Both fields are populated automatically after you select a date. Alternatively, you can manually enter the number of days in the Commitment Period field. The expiration date will then be automatically populated. When selecting a commitment period, be sure that you can make good delivery of loans by the expiration date of the commitment. Be sure that you allow sufficient time after closing for the transmission of loan data and the shipping of the loan documentation package. |

|

Commitment Expiration Date |

See Commitment Period (days) above. |

|

Remittance Type |

Select the desired remittance type from the drop-down list. · Actual/Actual: A method of sending mortgage payments that requires the seller to remit only the actual interest due (if it is collected from borrowers) and the actual principal payments that it collects from borrowers. · Scheduled/Scheduled: A method of sending mortgage payments that requires the seller to remit the scheduled interest due and the scheduled principal due whether or not payments are collected from borrowers. You must be approved for Scheduled/Scheduled remittance in order for this selection to be available. |

|

Purchase Price/Appraised Value |

Enter the purchase price or appraised value of the subject property as defined in the Calculation of the LTV Ratio section of the Selling Guide. |

|

Subordinate Financing |

Enter the amount of subordinate financing associated with the subject property. If none, enter 0. |

|

Credit Score |

Enter the representative credit score for the mortgage loan. If there is only one borrower, the single applicable score used to underwrite that borrower is the representative score for the mortgage. If there are multiple borrowers, determine the applicable credit score for each individual borrower and select the lowest applicable score from the group as the representative credit score for the mortgage. Note: The Selling Guide defines the representative credit score for a single and multiple borrower(s) in the section entitled, "Determining the Representative Credit Score for a Mortgage Loan". |

|

LTV |

Fixed field. The loan-to-value ratio is automatically calculated based on values you entered for the loan amount and purchase price/appraised value. |

|

CLTV |

Fixed field. The combined loan-to-value ratio is automatically populated based on values you entered for loan amount, purchase price/appraised value and subordinate financing. |

-

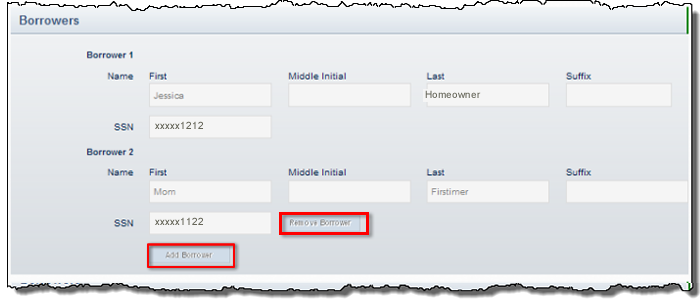

Enter the borrower(s)' name and social security number in the Borrowers section. If there is more than one borrower, click Add Borrower and enter the information for the additional borrower(s).

-

To remove a borrower(s) prior to committing, click Remove Borrower.

Note: The remove borrower button will remove the last borrower added. In the case of more than two borrowers, you may need to click Remove Borrower multiple times and re-enter your data.

-

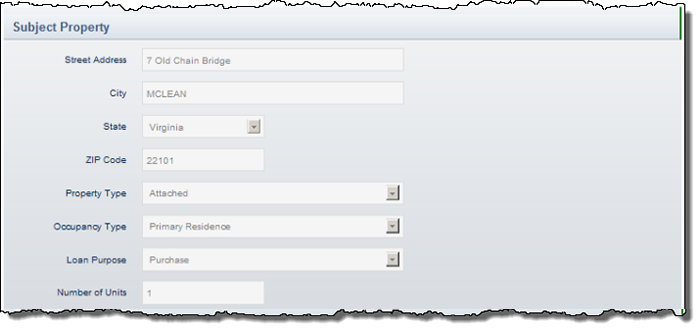

Enter information to complete the fields in the Subject Property section.

Note: Pre-qualification loans are not eligible for committing. A commitment requires a specified property address in order to commit a loan for sale to Fannie Mae.

-

Pay special attention to the following fields:

Field Name

Description/Instructions

Property Type

Select the appropriate type from the drop-down list. Options include: Detached, Attached, Condominium, Planned Unit Development (PUD), Cooperative (Co- op), Other, High Rise Condominium, Manufactured Housing, Detached Condominium, Manufactured Home/Condo/PUD/Co-op.

Occupancy Type

From the drop-down list, select whether the home will be a Primary Residence, Secondary Residence, or Investment Property.

Loan Purpose

From the drop-down list, select whether the loan purpose is Construction, Construction to Permanent, Other, Purchase, or Refinance.

Number of Units

Enter the number of units to be covered by the mortgage loan. For example, if the borrower is purchasing one unit in a condominium building with 50 units, enter 1.

-

You have two choices at the bottom of the page in order to proceed. The following buttons are available:

- Add To Eligible Loans - Adds this loan to your Eligible Loans Pipeline and you can commit at a later time. See Importing Eligible Loans for Best Efforts Committing job aid.

- Get Prices - Click Get Prices to proceed with committing the loan. The Sell Loans: Commitment Price screen opens.

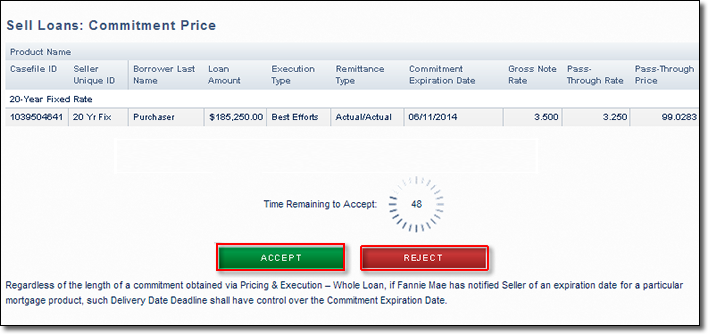

- From the Sell Loans: Commitment Price screen, review the commitment terms and Pass-Through Rate price.

- If you agree to the commitment terms and price, click Accept to finalize the commitment.

Note: You have 60 seconds to accept the commitment. All prices are "live" from 8:15 a.m. to 5:00 p.m. ET and may move throughout the day based on current market conditions. You may commit loans as best efforts after business hours until 10:00 p.m. ET. (Prices may vary from intraday.) If the 60-second window expires or if you click Reject, the system will return you to the Commit Loans screen.

- The Commitment Confirmation screen appears with information about the commitment. Click the Expand All | Collapse All links at the top of the page to view/hide all information. Click on the arrow next to each section heading to expand or collapse individual sections.

- The PE – Whole Loan application automatically generates an email confirmation of your transaction. An email confirmation will only be sent if an email address has been added to your contact information. For more information, see the Setting Up Your Contact Preferences job aid.

- To export a Commitment Confirmation screen to a comma-delimited (.csv ) file, click the Export icon

at the upper right of

your screen.

at the upper right of

your screen. - To print the Commitment Conformation screen, click the Print icon

at the upper right of your screen.

at the upper right of your screen. - To make another commitment, click Make Another Commitment at the bottom of the screen.