My web

HomeStyle® Renovation & HomeStyle® Energy

![]()

This document explains the specific steps for entering data for HomeStyle® Renovation mortgages and HomeStyle® Energy mortgages. This document is not intended to provide detailed instructions for entering all the loan application data in Desktop Underwriter® (DU®).

You may scroll through this document or click a link to be taken to the information for the specified topic:

HomeStyle Renovation

The Homestyle Renovaton mortgage enables a borrower to purchase a property or refinance an existing loan and include funds in the loan amount to cover the costs of repairs, remodeling, renovations, or energy improvements to the property. For more information about HomeStyle Renovation, refer to the Selling Guide. You can also refer to the HomeStyle Renovation web page.

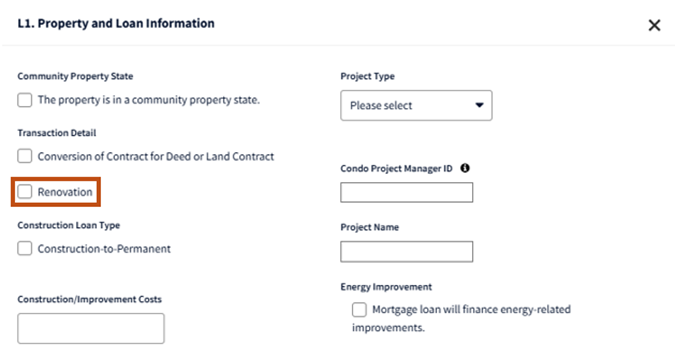

In order for the loan casefile to be underwritten as a HomeStyle Renovation mortgage, you must enter an amount on line B. Improvements, Renovations, and Repairs in section L4. Qualifying the Borrower, and must also click the Renovation checkbox in section L1. Property and Loan Information.

-

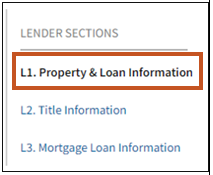

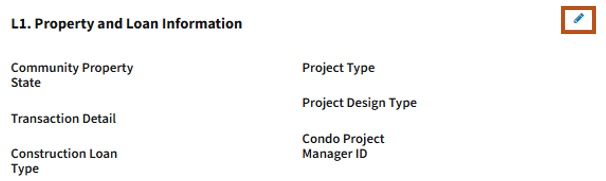

Click onL1. Property & Loan Information in the navigation bar.

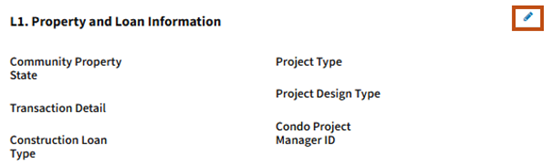

- Click the Edit icon on theL1. Property and Loan Information screen.

- Click the Renovation checkbox.

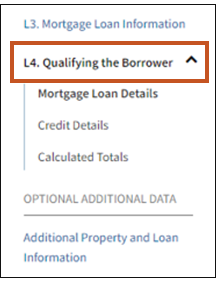

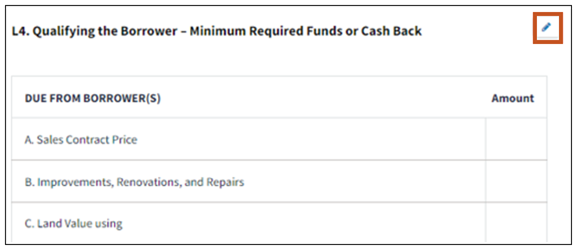

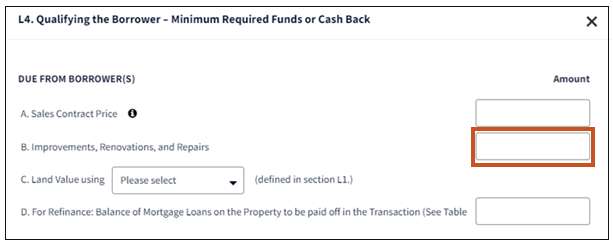

- Click on L4. Qualifyingthe Borrower in the navigation bar.

- Click the Edit icon on the L4. Qualifying the Borrower screen.

- Enter the amount of renovations on line B. Improvements, Renovations, and Repairs.

HomeStyle Energy

The HomeStyle Energy mortgage helps lenders offer financing for homeowners to increase home energy efficiency and reduce utility costs. For more information about HomeStyle Energy, refer to the Selling Guide. You can also refer to the HomeStyle Energy web page.

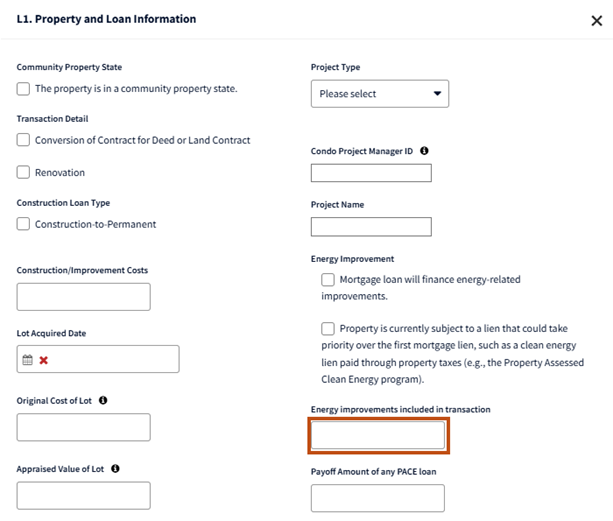

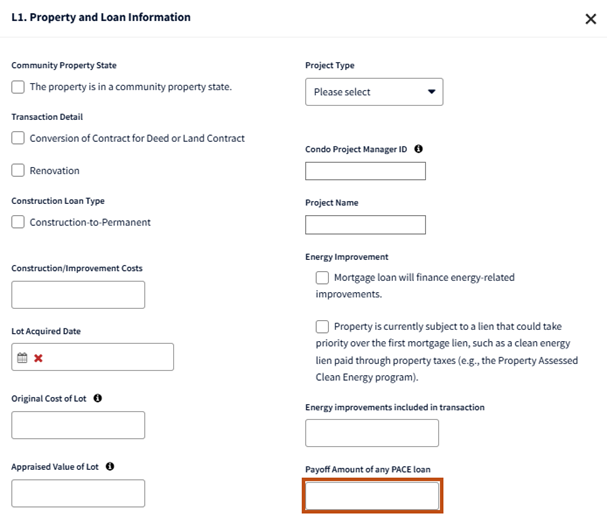

If an amount is provided in either the Energy improvements included in transaction field or the Payoff Amount of any PACE loan field, the loan will be underwritten as a HomeStyle Energy transaction.

- Click onL1. Property & Loan Information in the navigation bar.

- Click the Edit icon on theL1. Property and Loan Information screen.

- Enter the amount of new energy improvements that are included in the purchase or limited cash-out transaction, and any non-PACE energy debt being paid off with the limited cash-out transaction in theEnergyimprovementsincluded in transaction field. Non-PACE energy debt included in this field should not be included in Section L4 Line D or Line E.

- Enter the payoff amount of any existing PACE loans that will be paid off in the subject transaction in thePayoff Amount of any PACE loan field. PACE energy debt should not be included in Section L4 Line D or Line E.

Notes: If a PACE loan or energy improvement loan that is being paid off is in the Liabilities section, then it should be marked To be paid off at or before closing so it is listed in the message to include evidence of the payoff, and it should also be markedOmit, so that the balance is not added to the Funds Required to Close. DU will add the balance for the PACE loan or energy improvement loan entered in section L1. Property and Loan Information to the Funds Required to Close.

Transactions that are both HomeStyle Renovation and HomeStyle Energy: For HomeStyle Renovation transactions where there is a single contract price (i.e., the energy improvements are included in the total contract price with non-energy improvements), or there are multiple contracts (i.e., one contract for the addition to the home and another for the solar panels), the total contract price can be entered in Section L4 Line B. The energy improvements do not need to be broken out separately and included in the Energy improvements included in transaction field. When the total contract price is entered in Section L4 Line B., lenders should click the Mortgage loan will finance energy-related improvements checkbox to ensure DU is underwriting the loan as a HomeStyle Energy loan and SFC 375 is issued on the DU Underwriting Findings report.

PACE or Energy improvement loan payoff of a cash-out refinance: If there is an outstanding PACE loan being paid off in a cash-out refinance transaction then the PACE payoff amount should be included in Section L4 Line E., not in the Payoff Amount of any PACE loan field. If there is an outstanding non-PACE energy loan being paid off in a cash-out refinance transaction then the payoff amount should be included in Section L4 Line E., not in the Energy improvements included in transaction loan field.

Related Job Aids

Refer to the HomeReady Loan job aid, for detailed instructions for entering a Fannie Mae HomeReady® Loan.