My web

FHA Loan

![]()

This document explains the specific steps for entering certain data for an FHA loan casefile. This document is not intended to provide detailed instructions for entering all the loan application data in Desktop Underwriter® (DU®).

Note: The maximum number of borrowers that can be entered into DU for the FHA loan casefile is four.

-

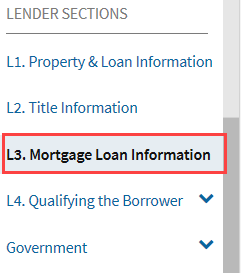

For the loan casefile you want to submit as an FHA loan, click section L3. Mortgage Loan Information in the navigation bar.

-

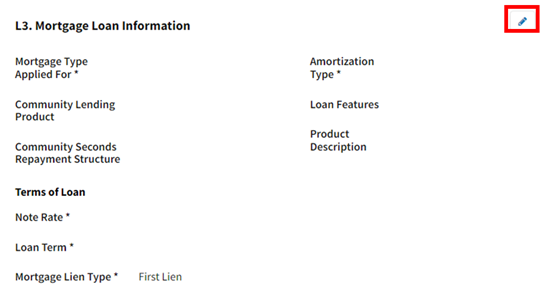

In the L3. Mortgage Loan Information screen, click the Edit icon.

-

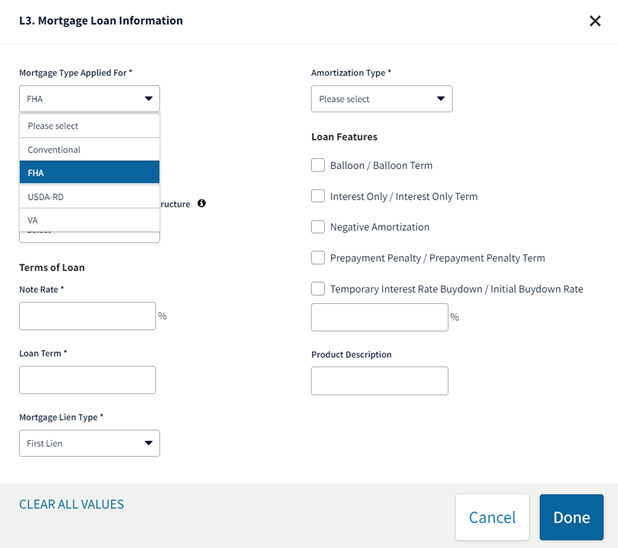

From the Mortgage Type Applied For drop-down list, select FHA.

Note: The First Lien option in the Mortgage Lien Type drop-down list is the only one supported for FHA loan casefiles. Also, the Balloon, Interest Only, and Negative Amortization loan features are not allowed on FHA loan casefiles.

-

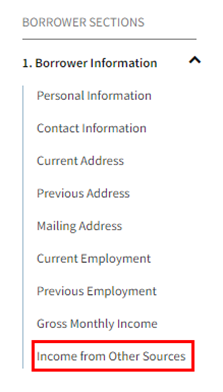

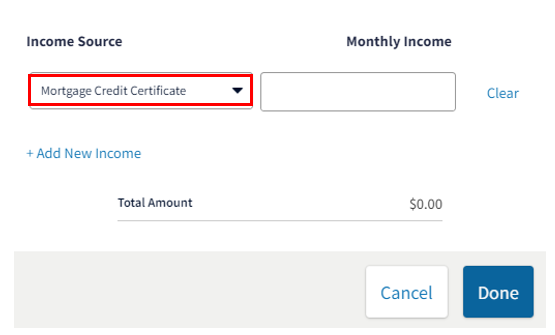

If there is a Mortgage Credit Certification and it needs to be shown as income based on FHA policy, enter it as an income type. Expand section 1. Borrower Information in the navigation bar and click Income from Other Sources.

- In the 1e. Income from Other Sources screen, click the Edit icon.

-

From the Income Source drop-down list, select Mortgage Credit Certificate and enter the monthly amount.

If the Mortgage Credit Certification (MCC) needs to be deducted from the housing expenses based on FHA policy, enter it on the first screen in the FHA and VA Loans section (see steps 26 through 28 below).

Note: The following income types are used for conventional loans only and in most cases result in an error if selected and in all cases the income amount is not used in underwriting: Accessory Unit Income, Capital Gains, Employment Related Account, Housing Allowance, Housing Choice Voucher Program, Non-Borrower Household Income, Public Assistance, Royalties, Separate Maintenance, Temporary Leave, and Tip Income. In addition, Foreign Income and Seasonal income, which are entered in section 1b. Current Employment/Self Employment and Income, will result in an error.

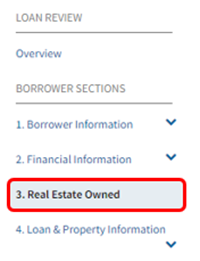

- If the borrower owns real estate, select 3. Real Estate Owned to add those properties to the loan application.

- In Section 3: Real Estate Owned, click ADD PROPERTY.

- The section will expand. Click the Edit icon next to Property Information.

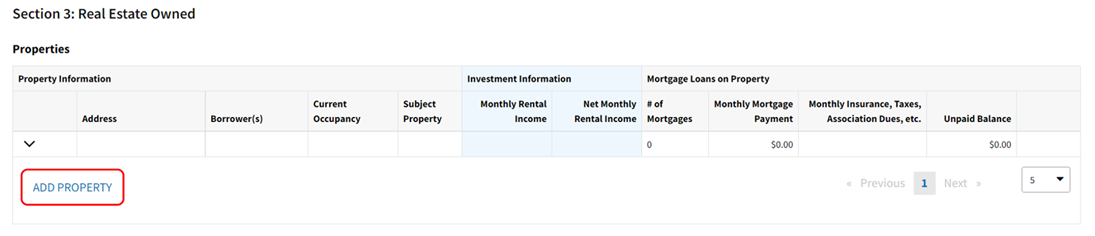

- Complete the applicable fields in the Property Information screen:

- If none of the borrowers own any real estate, check the I do not own any real estate box.

- Enter the street address fields for the property.

- Select the Current Occupancy from the drop-down list.

- Select the Intended Occupancy of that property from the drop-down list. Other is currently not a valid selection for government loans.

- If the record is for the subject property, place a check mark in the This is the subject property box field.

- Choose the borrower that owns the property from the Borrower(s) That Own Property drop-down list. If there is a liability for this property in section 2c. Liabilities - Credit Cards, Other Debts, and Leases that you Owe, make sure the account owner selected there matches the borrower selected here in Borrower(s) That Own Property.

- Enter the Property Value, whether Estimated or Appraised, in the appropriate field.

- Select the Status of the property from the drop-down list.

- If the insurance, taxes, and other fees are not included in the monthly mortgage payment for the property in section 2c. Liabilities - Credit Cards, Other Debts, and Leases that You Owe, include them in the Monthly Insurance, Taxes, Association Dues, etc. field.

Once you have finished entering the applicable data, click Done.

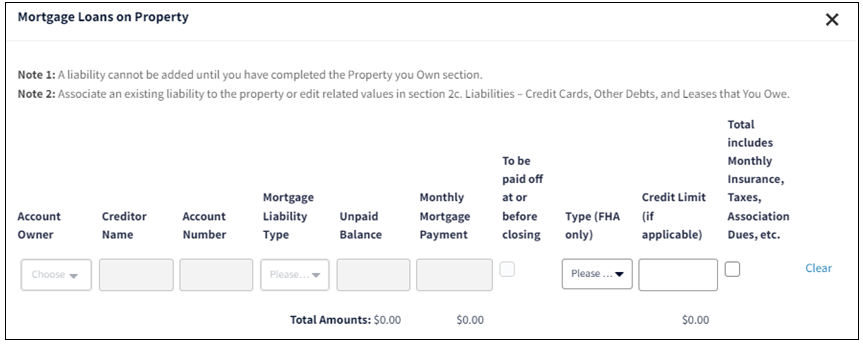

- Click the Edit icon next to Mortgage Loans on Property.

- Enter the editable information for the mortgage(s) and/or HELOC(s). If the existing mortgage loan is an FHA loan, select FHA in the Type (FHA only) drop-down list.

Note: Most of the fields on this screen can only be entered and/or edited on the 2c. Liabilities - Credit Cards, Other Debts, and Leases that You Owe screen.

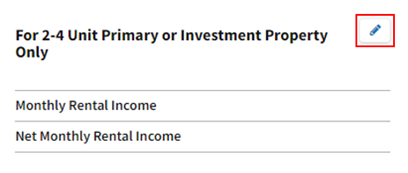

- If there is a rental income associated to the property, click the Edit icon next to For 2-4 Unit Primary or Investment Property Only to enter the applicable data. Refer to the Navigating Loan Application Fields job aid for additional information about entering rental income.

- If there are additional Real Estate Owned properties, repeat steps 8 through 13.

Note: If the transaction is a refinance, the subject property should be entered first.

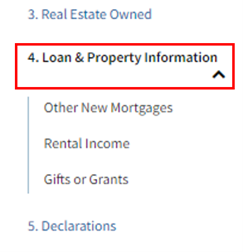

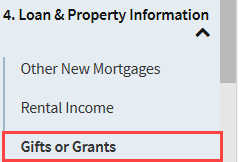

- Click section 4. Loan & Property Information in the navigation bar.

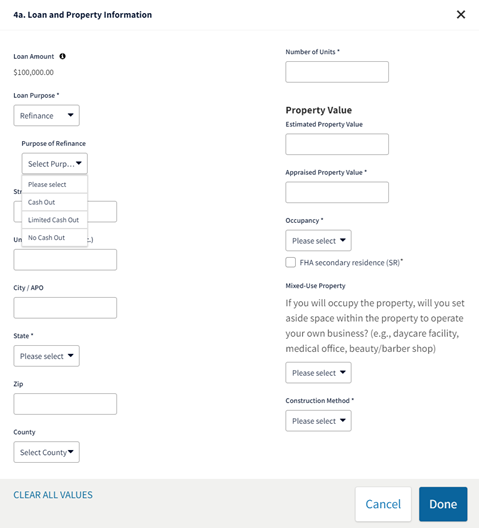

- In the 4a. Loan and Property Information section, click the Edit icon.

- Select the Loan Purpose. If Refinance is selected, the Purpose of Refinance field will appear. Limited Cash Out is not a valid option for FHA loans in DU.

- If the property usage falls under the FHA Secondary Residence policy and guidelines, please a check mark in the FHA secondary residence (SR) field.

- If a gift or grant will be used, click Gifts or Grants.

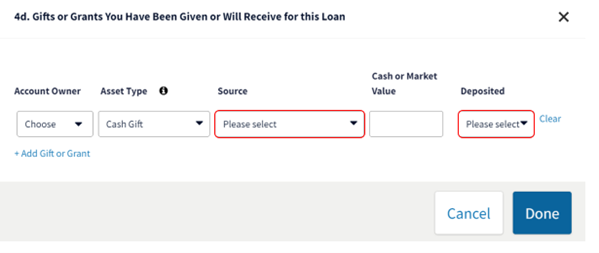

- In the 4d. Gifts or Grants You Have Been Given or Will Receive for this Loan screen, click the Edit icon.

- Complete the applicable fields:

- Choose the borrower who owns the account in the Account Owner field.

- Select the appropriate Asset Type from the drop-down list.

- Select the applicable provider from the Source drop-down list.

- Enter the total amount in the Cash or Market Value field. The full amount of the gift or grant must be entered.

- If the gift or grant has been deposited in an asset account (i.e. savings account), select Yes in the Deposited field. If the gift or grant has not been deposited in an asset account, select No in the Deposited field.

- If there is more than one gift or grant, click + Add Gift or Grant and repeat steps a through f.

Note: The full amount of the gift(s) or grant(s) needs to be entered.

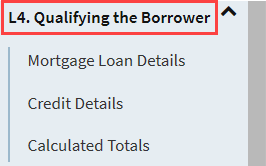

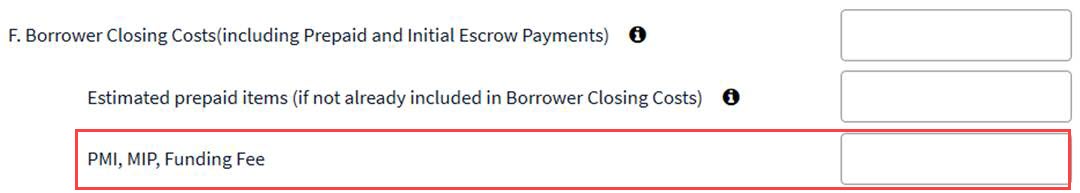

- To enter the Mortgage Insurance Premium (MIP), click section L4. Qualifying the Borrower in the navigation bar.

- In the L4. Qualifying the Borrower – Minimum Required Funds or Cash Back screen, click the Edit icon.

-

Enter the entire MIP amount in the PMI, MIP, Funding Fee field.

-

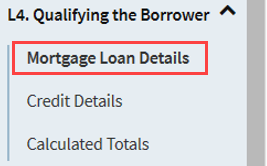

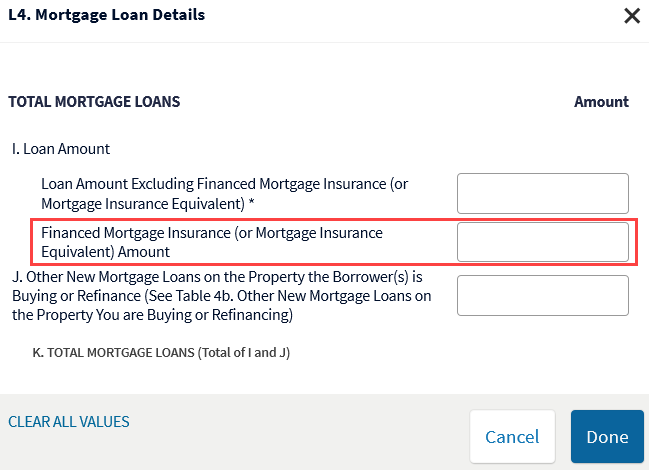

Expand section L4. Qualifying the Borrower in the navigation bar and click Mortgage Loan Details.

-

In the L4. Mortgage Loan Details screen, click the Edit icon.

-

Enter the amount of the MIP that will be financed in the Financed Mortgage Insurance (or Mortgage Insurance Equivalent) Amount field (the second amount field for line I.).

-

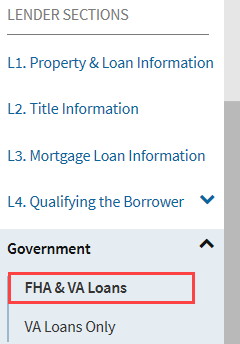

Expand section Government in the navigation bar and click FHA & VA Loans.

-

For the first screen in the FHA and VA Loans, click the Edit icon.

-

Complete the applicable fields:

-

If you enter an amount in the Mortgage Credit Certificate (MCC) field, it is deducted from the housing expenses. If it needs to be shown as income based on FHA policy, then it should be entered as an income type (see step 6).

-

Use the Seller Concessions field to enter the dollar amount of seller concessions in excess of the FHA’s limitation, if you have not already reduced the loan amount by the amount of the seller concession.

-

Complete the Agency Case Number field by the final submission. See the note below for more details.

-

If you are doing a refinance transaction and part of the previous upfront mortgage insurance will be refunded, enter that amount in the MIP Refund Amount field. It should not be entered as a credit.

-

If you are doing a refinance transaction, select the Government Refinance Type from the drop-down list. (Required for FHA or VA refinance transactions).

-

Select Yes or No to indicate if the property is a Property Energy Efficient Home.

-

From the Section of the National Housing Act drop-down list, select the applicable section.

-

Enter the applicable ID number(s). If a sponsoring lender is not needed, enter the FHA Lender ID. If a sponsoring lender is required, enter both the FHA Sponsor ID and Sponsored Originator EIN.

-

Select Yes or No in the Positive Rental History field based on FHA Policy.

-

Note: The Agency Case Number field is not required to submit the loan for an underwriting recommendation; however, it is required to obtain FHA insurance. You must enter a valid FHA case number in this field, so leave it blank if you don’t have one yet. If you do not complete the Agency Case Number field, DU displays a warning message. In this case, click DONE. If you do not complete the Agency Case Number, then the underwriting recommendation and findings could be inaccurate.

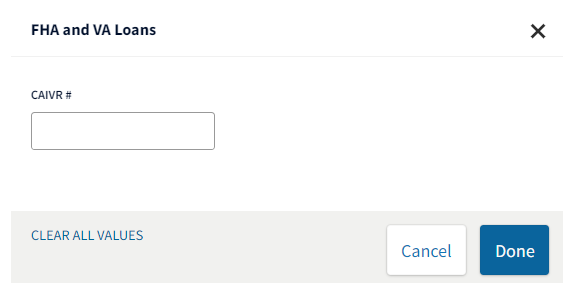

- If you have the CAIVR number, click the Edit icon for the second screen in FHA and VA Loans.

- Enter the CAIVR# and click Done.

Note: In addition to the values/fields mentioned in this job aid, there are some other values/fields on the redesigned Form 1003 that DU for government loans will not use, and those that may be used by DU for government loans in a future release. When existing messages are updated or new messages are added using other new fields, the details will be included in future DU for government loans release notes. As always, you must ensure full compliance with all FHA eligibility requirements and all requirements of FHA Single Family Housing Policy Handbook 4000.1.