My web

Responding to an Initial DVC Data Defect or Secondary Lender Action - Manager

![]()

A Data Validation Center (DVC) review can be performed for a data only issue or after a full file loan review has been completed and Fannie Mae retains the loan. All DVC reviews are now performed in Loan Quality Connect – you don’t have to log in to any other systems. Uploading DVC documents in Loan Quality Connect means you’ll see data changes and trade comments with reviewers in real time, eliminating manual workarounds.

When Fannie Mae notifies you in Loan Quality Connect of a proposed DVC data defect or secondary lender action, you can elect to:

-

Agree and provide requested documentation,

-

Disagree and provide the documentation supporting your rebuttal, or

-

Request additional time to provide requested document.

If you choose to rebut the data defect, Fannie Mae will evaluate your rationale and supporting documentation before making its decision. If your rebuttal is accepted, the DVC review will be closed. If further action on your part is required or if Fannie Mae disagrees with your rebuttal, the loan will be placed in DVC Secondary Lender Action Required status.

Follow these steps to respond to a DVC Request (Initial and Secondary Lender Action) after logging in to Loan Quality Connect:

-

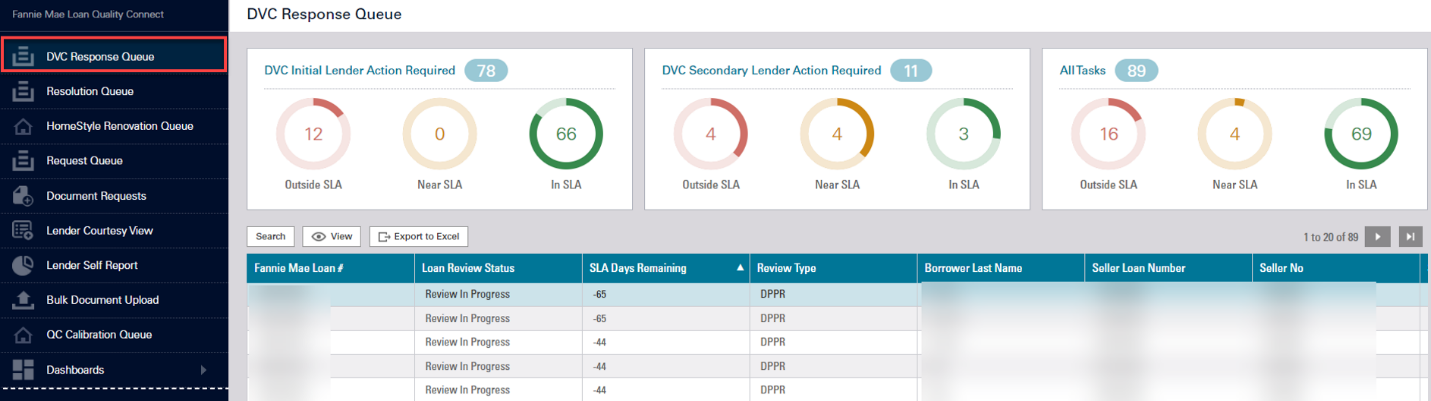

Click DVC Response Queue.

-

Click the business intelligence card (BI) card for the service level agreement (SLA) category you want to work on. Loans within the selected SLA category display below the BI cards.

DVC Initial Lender Action Required - initial finding found by the DVC analyst that could result in a data change or loan ineligibility.

DVC Secondary Lender Action Required - additional action required by the lender if the rebuttal information is unacceptable or if any additional documentation is required.

All Tasks - the total of initial and secondary actions required.

In the example below, the Outside SLA BI card is selected because those loans have exceeded their SLA timeline and become a priority in the workflow. Loans with a DVC Initial Lender Action Required, Outside SLA status populate the search result area under the BI cards.

Note: See Service Level Agreements (SLAs) for an explanation of each SLA category.

-

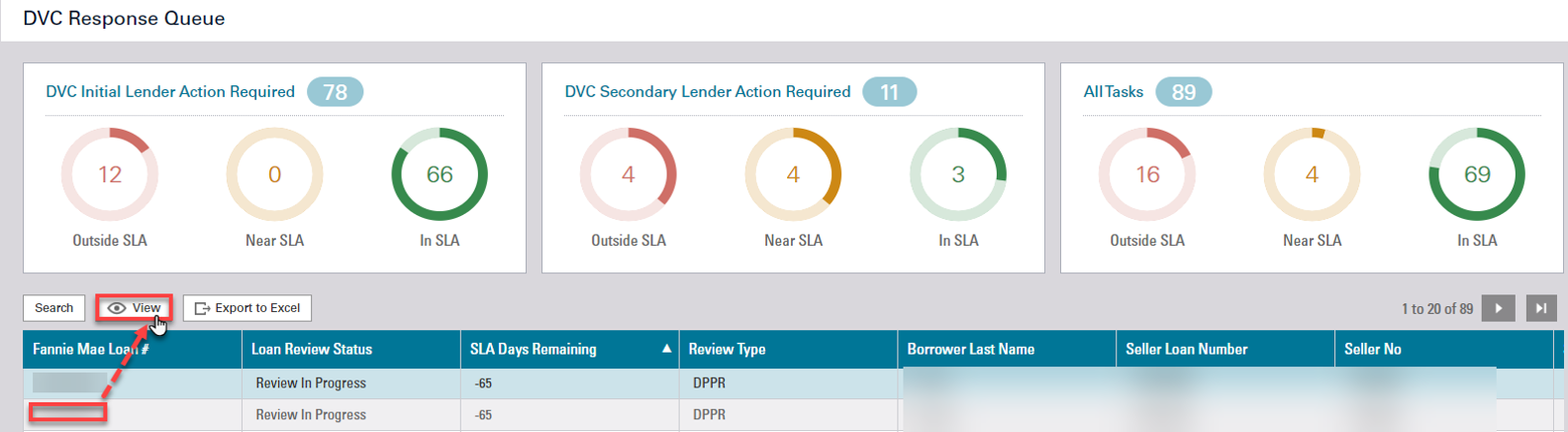

Click the loan of your choice, and then click View – or simply double click the loan – to open the Loan Details screen and perform further actions on that loan.

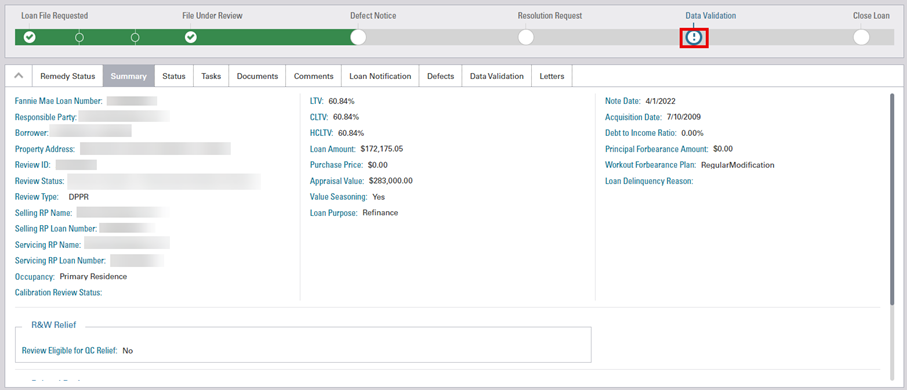

The Loan Details page opens, defaulting to the Summary screen. Confirm that the loan information on the Summary screen is accurate.

The green progress bar at the top of the screen is updated based on the current task associated with the loan review. For loans needing a data change only (no file review was completed), the progress bar will reflect File Under Review. If the loan file has been reviewed and moved forward to Lender notification, it will be updated to reflect Defect Notice and then Resolution Request. Once the Lender has the chance to review the defect and associated comments, and provided an appeal that cured the defect, if the loan requires a data change, the progress bar will move forward to Data Validation. After the Lender has concurred to the data change, Fannie Mae will submit the data change on the Lender's behalf. Once the data change has been confirmed as completed, Fannie Mae will assign a Final Action Code to the Review and the progress bar will be updated to reflect Close Loan.

Note: You can click the information icon under File Under Review on the progress bar to see the status of the DVC review.

-

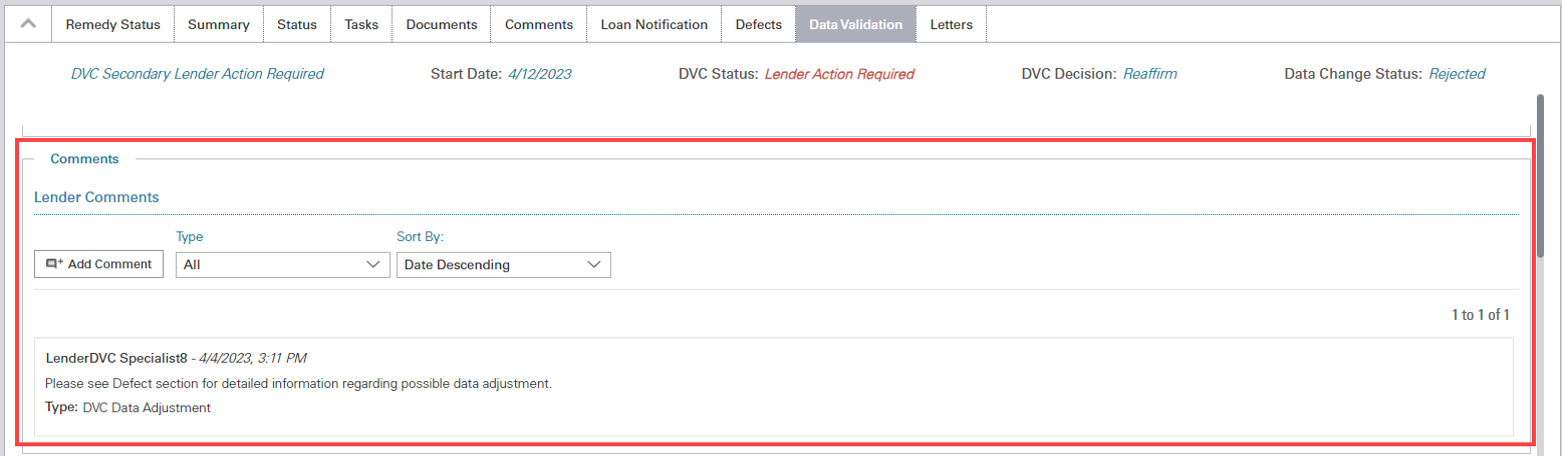

Click the Data Validation tab and navigate down to the Comments section to find out what Fannie Mae is requesting you to do. In our example, the Lender is being referred to the Defects section or detailed information regarding a possible data adjustment.

-

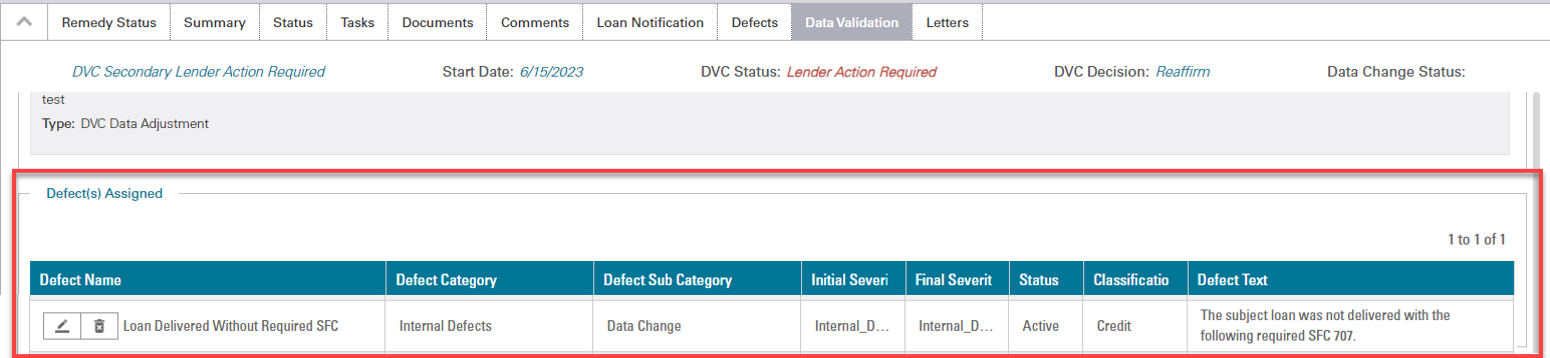

Navigate down to the Defect(s) Assigned section for a detailed explanation of the defect. In our example, the defect reflects that the subject loan was delivered without Special Feature Code (SFC) 707.

Note: Navigate to the Documents section and upload any requested supporting documentation before you concur/rebut and exit the loan. Refer to the Uploading DVC Data Defect or Adjustment Documentation job aid on how to provide supporting documentation.

-

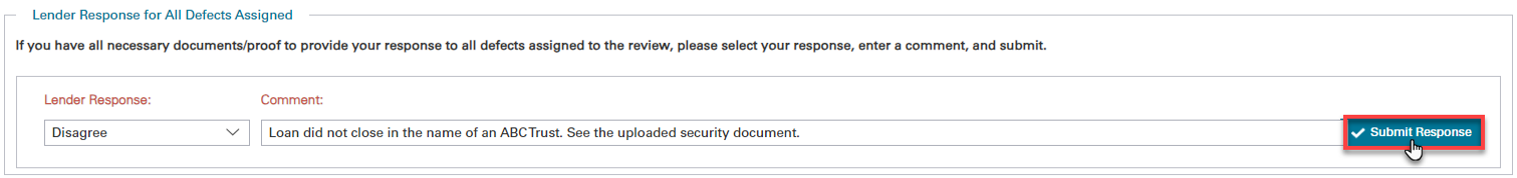

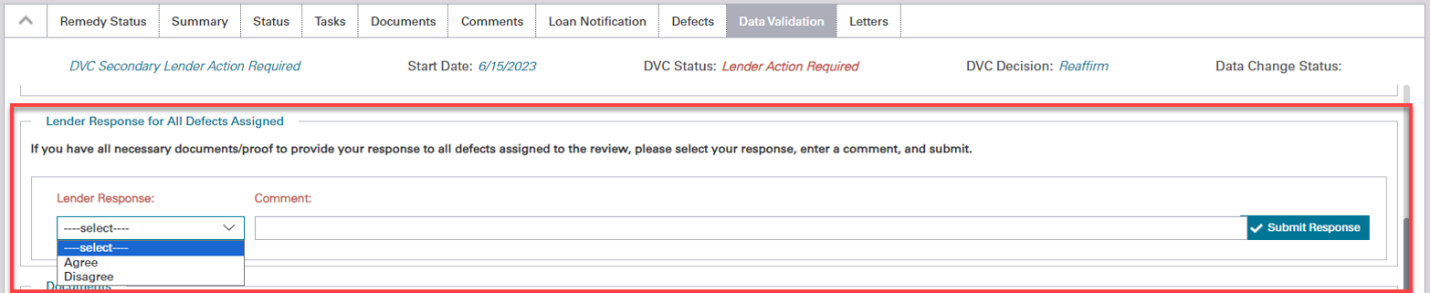

Navigate to the Lender Response for All Defects Assigned section and then click the Lender Response drop-down menu for response options.

-

Make your selection to Agree or Disagree from the Lender Response drop-down menu.

Note: Although you are selecting your Agree or Disagree response from the Data Adjustment tab, you are Agreeing or Disagreeing to the Defect(s) added to the loan review and not data adjustments.

-

Add your rationale for your selection in the Comment text box and click Submit Response.