My web

Guidelines for Temporary Interest Rate Buydowns

![]()

The purpose of this job aid is to provide additional information on data fields required in the Loan Delivery application when the loan has a temporary interest rate buydown.

For detailed instructions on how to perform other tasks, see the Loan Delivery User Guide , eLearning tutorials, or other job aids. If you do not have access to Loan Delivery and require it, please contact your Technology Manager administrator.

Temporary Buydowns

A temporary buydown allows borrowers to reduce their effective monthly payment for a limited period of time through a temporary buydown of the interest rate.

In a temporary buydown, the effective interest rate that a borrower pays during the early years of the mortgage is reduced as a result of the deposit of a lump sum of money (sometimes called a “subsidy”) into a buydown account, a portion of which is released each month to reduce the borrower's payments. The buydown funds may be provided by various parties, including the borrower, the lender, the borrower’s employer, the property seller, or other interested parties to the transaction. Refer to the Selling Guide for information on allowable sources of temporary buydown funds.

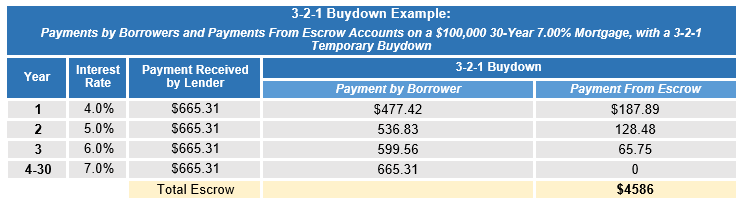

A common temporary buydown is a “3-2-1,” meaning the mortgage payment in years one, two, and three is calculated at rates of 3 percent, 2 percent, and 1 percent, respectively, below the rate on the loan. The actual note rate and monthly payment that the borrower is obligated to pay is never actually reduced, and the full rate and payment must be reflected on the mortgage documents. At the end of the buydown period, the buydown funds collected at closing will have been exhausted, and the buydown period ends. See the example below for additional context.

Temporary Buydown Example