My web

Appraisal Modernization

![]()

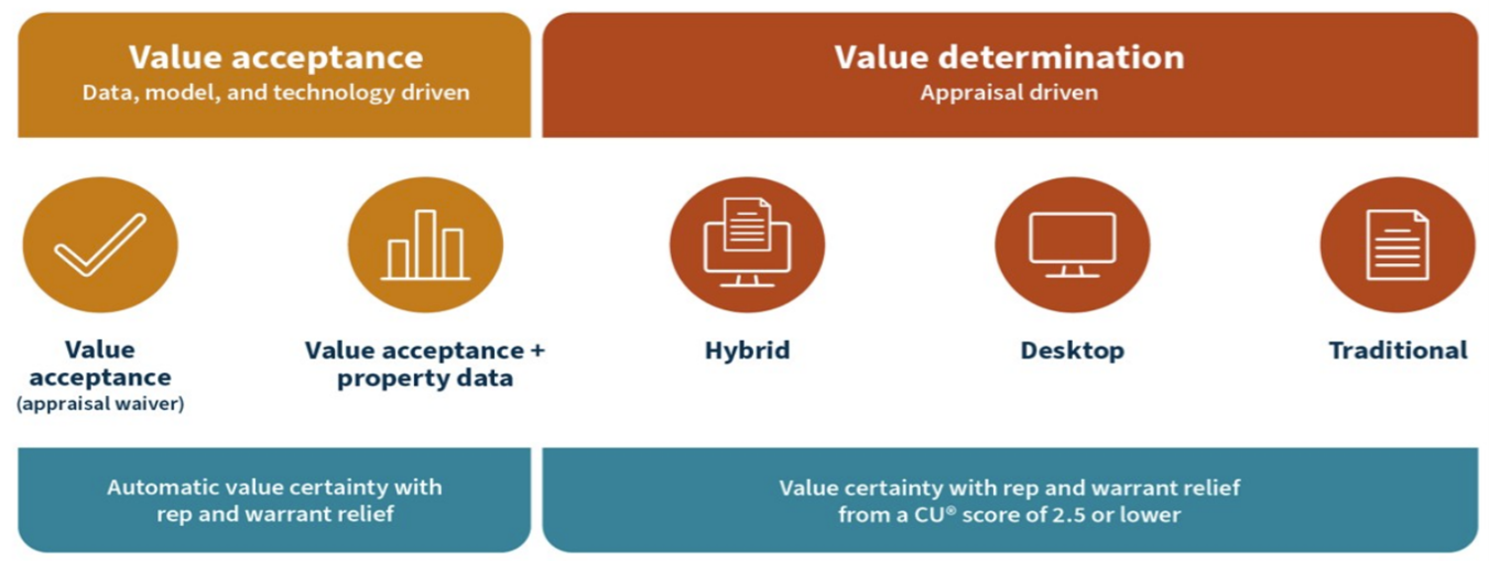

The Modern Valuation Spectrum

Fannie Mae is on a journey of continuous improvement to make the home valuation process more efficient and accurate. We are transitioning to a spectrum of options to establish a property’s market value, with the option matching the risk of the collateral and the loan transaction. The spectrum balances traditional appraisals with appraisal alternatives.

Exercising the Options

Data, model, and technology driven |

Value Determination Appraisal driven |

|

|

When exercising a hybrid appraisal, the lender must complete all of the following:

|

Resources:

- Value Modernization

- + Property Data Fact Sheet

- Lender Checklist

- Loan Delivery Job Aid Delivering a Loan Without an Appraisal

| Loan Delivery Sort ID | Loan Delivery Field Name in Loan Delivery |

|

Value Determination Appraisal Driven | ||||

| (Appraisal Waiver) | + Property Data | ||||||

| (non-High LTV Refinance) | (High LTV Refinance) | Hybrid | Desktop | Traditional | |||

| 82 | Appraisal Document File ID | Not Required, leave blank | Not Required, leave blank | Not Required, leave blank | Enter UCDP Doc File ID | Enter UCDP Doc File ID | Enter UCDP Doc File ID |

| 83 | Appraisal Amount |

|

Enter the estimated value |

|

Enter the value on the original appraisal | Enter the value on the original appraisal | Enter the value on the original appraisal |

| 84 | Appraisal Effective Date | Not Required, leave blank | Not Required, leave blank | Not Required, leave blank | Enter the date on the original appraisal | Enter the date on the original appraisal | Enter the date on the original appraisal |

| 85 | Property Valuation Form | Not Required, leave blank | Not Required, leave blank | Not Required, leave blank |

Enter appropriate appraisal type:

|

Enter appropriate appraisal type:

|

Enter appropriate appraisal type:

|

| 89/90 | Appraisal Method | Enter "None" | Enter "None" | Enter "None" | Enter "Hybrid Appraisal" | Enter "Desktop Appraisal" | Enter "Full Appraisal" |

| 368 | Investor Feature Code | Enter "801" | "807" has been auto populated | Enter "774" | n/a | n/a | n/a |

| 376 | Investor Collateral Program Identifier | Enter "Value Acceptance" | Enter "Value Acceptance" | Enter "Value Acceptance" | n/a | n/a | n/a |

| 525 | Appraiser's State License Number | Not Required, leave blank | Not Required, leave blank | Not Required, leave blank | Enter the appraiser's state license or cert no. | Enter the appraiser's state license or cert no. | Enter the appraiser's state license or cert no. |

| 534 | Supervisory Appraiser's State License Number | Not Required, leave blank | Not Required, leave blank | Not Required, leave blank | Enter the supervisory appraiser's state license or cert no. IF a supervisor signed the appraisal | Enter the supervisory appraiser's state license or cert no. IF a supervisor signed the appraisal | Enter the supervisory appraiser's state license or cert no. IF a supervisor signed the appraisal |