My web

Community Seconds

![]()

This document explains the specific steps for entering data for a Community Seconds® mortgage loan as a subordinate lien on a purchase transaction. This document is not intended to provide detailed instructions for entering all the loan application data in Desktop Underwriter® (DU®). For more information about Community Seconds®, refer to the Selling Guide.

-

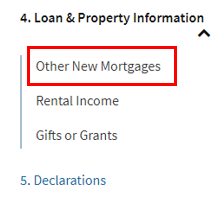

From the loan casefile you want to submit with a Community Seconds subordinate lien, expand section 4. Loan & Property Information in the navigation bar and click Other New Mortgages.

-

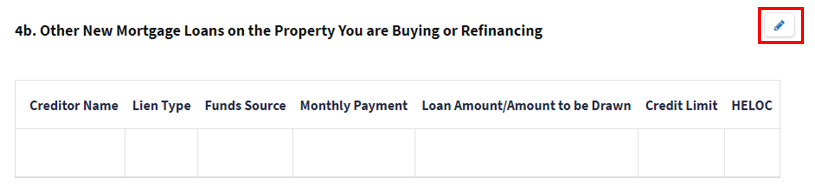

In the 4b. Other New Mortgage Loans on the Property You are Buying or Refinancing screen, click the Edit icon.

-

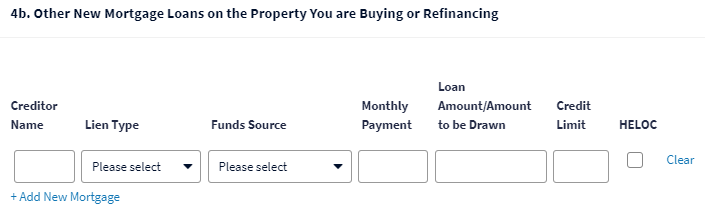

Enter the details for the Community Seconds loan in the fields provided, and click Done.

-

Click section L3. Mortgage Loan Information in the navigation bar.

-

In the L3. Mortgage Loan Information screen, click the Edit icon.

-

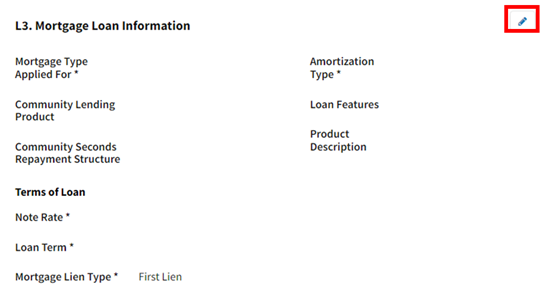

If you are using HomeReady® for the first mortgage, from the Community Lending Product drop-down list, select HomeReady. Then select the appropriate option from the Community Seconds Repayment Structure drop-down list.

Note: The first mortgage does not have to be a Community Lending product.

The Deferred options (Deferred Fully Forgiven and Deferred Not Fully Forgiven) should only be used if repayment is deferred for five years or more. The Non Deferred option should be used when any payment is required within the first five years. When the Deferred options are used - regardless of whether the Community Seconds mortgage is fully forgiven - DU will base the risk assessment on the LTV, rather than the CLTV.

When Community Seconds mortgage is an existing lien that will be resubordinated in a refinance transaction, the Deferred options should only be used if the repayment deferral continues five or more years from the closing date of the new first mortgage. For example, if the existing Community Seconds mortgage was originated two years ago with repayment for five years, the remaining deferred repayment period would be three years, so Non Deferred should be provided as the Community Seconds Repayment Structure.

-

When you are finished entering the necessary data for other required fields in L3. Mortgage Loan Information, click Done.

-

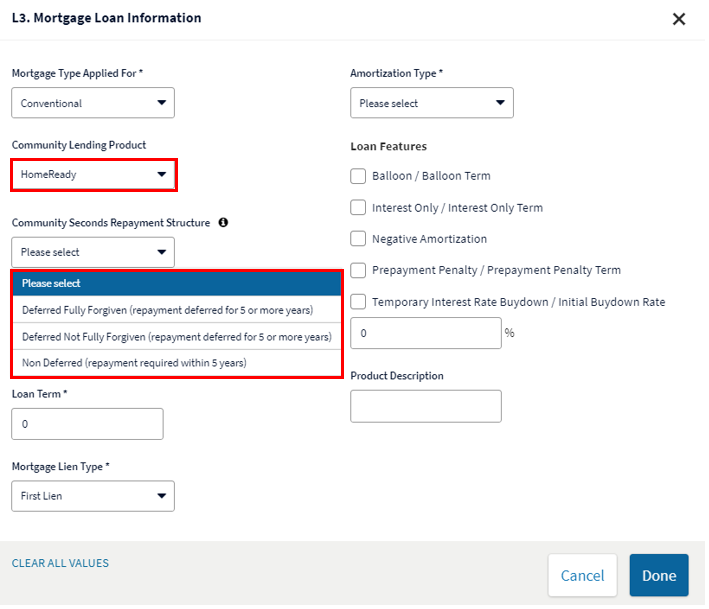

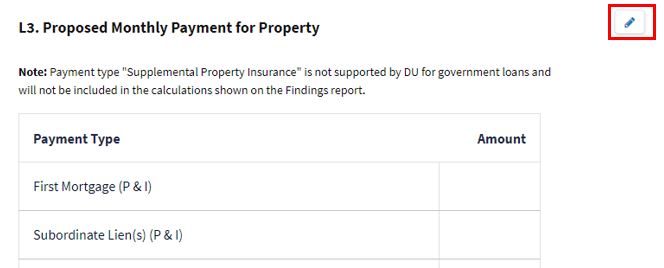

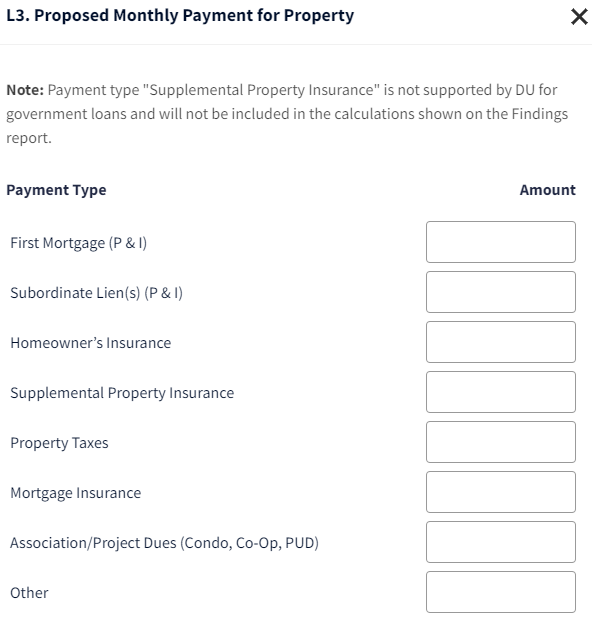

Next, navigate to section L3. Proposed Monthly Payment for Property, and click the Edit icon.

-

Enter the subordinate financing payment amount in the Subordinate Lien(s) (P & I) field, if a payment is required.

Note: When the repayment of a Community Seconds mortgage is deferred for five years or more, you are not required to enter a monthly payment in the online loan application. However, when the repayment is not deferred for at least five years, you must enter the repayment amount in section L3. Proposed Monthly Payment for Property as Subordinate Lien(s) (P&I).

-

When you are finished entering the necessary data for other required fields in L3. Proposed Monthly Payment for Property, click Done.

-

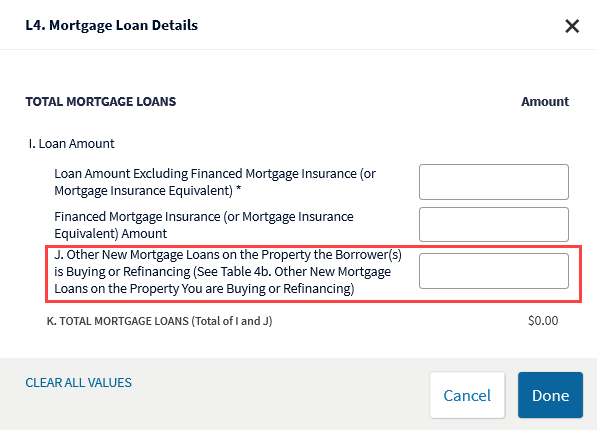

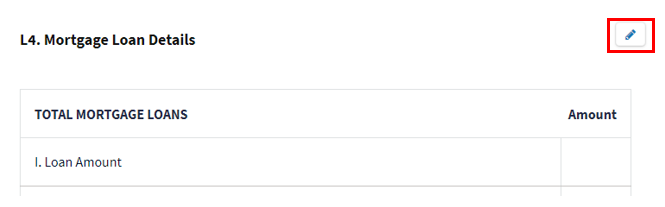

Expand section L4. Qualifying the Borrower in the navigation bar and click Mortgage Loan Details.

-

In the L4. Mortgage Loan Details screen, click the Edit icon.

-

Enter the subordinate lien amount in the J. Other New Mortgage Loans on the Property the Borrower(s) is Buying or Refinancing field. The balance entered here should match the total subordinate lien balance entered in section 4b. Other New Mortgage Loans on the Property You are Buying or Refinancing.