My web

Customizing Dashboard Reports

![]()

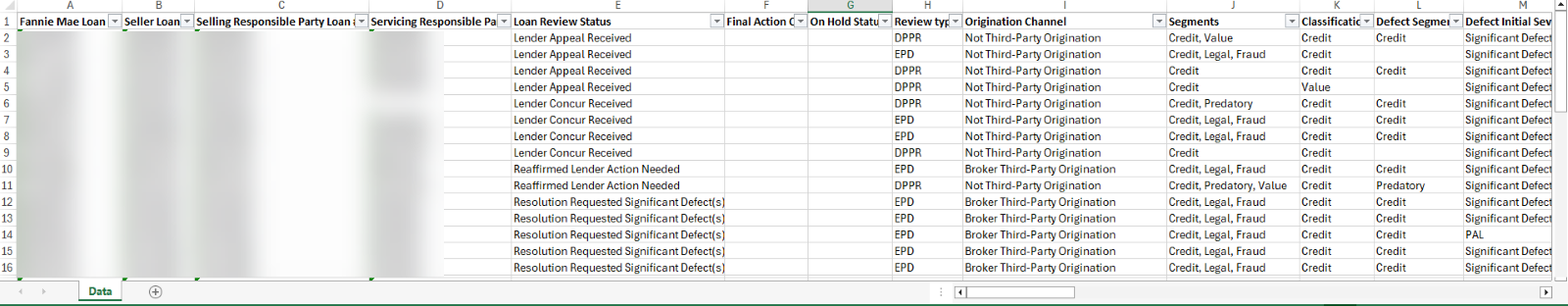

Loan Quality Connect's Dashboard feature includes the ability to customize reports and export report data to an Excel spreadsheet.

Note: Click here to view more dashboard information.

Responsible Party Reports

Follow these steps to create a custom lender dashboard report:

-

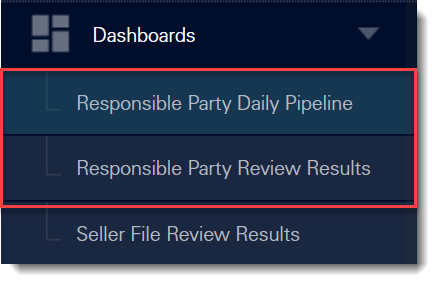

After logging in to Loan Quality Connect, click Dashboards and select Responsible Party Daily Pipeline or Responsible Party Review Results.

-

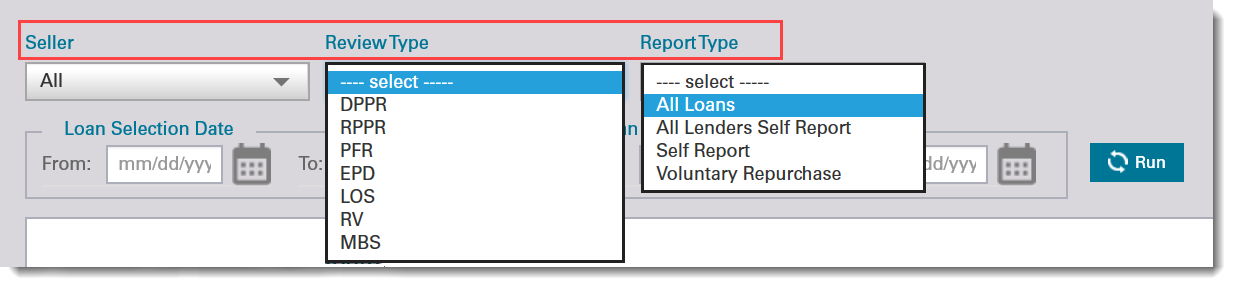

From the drop-down menus, select the name of your organization (Seller), the Review Type, and the Report Type.

Review Types Report Types DPPR: Discretionary Post Purchase Review - selections made by a risk-based model that allows for specialized analysis and early loss anticipation/mitigation.

RPPR: Random Post-Purchase Review - selections based on random sampling models.

PFR: Post Foreclosure Review - selections made after a non-performing loan has been liquidated.

EPD: Early Payment Default Review - selections based on delinquency.

LOS: Loss Mitigation Review - selections based on loss mitigation activities.

RV: Recourse Violations - loans that are subject to recourse provisions.

MBS: Mortgage-Backed Securities Review - loans targeted for MBS review.

All Loans: includes all reports excluding All Lender Self Report, Self Report and Voluntary Repurchase report types.

All Lenders Self Report: only includes All Lender Self Report(s).

Self Report: only includes Self Report(s).

Voluntary Repurchase: only includes Voluntary Repurchase reports.

-

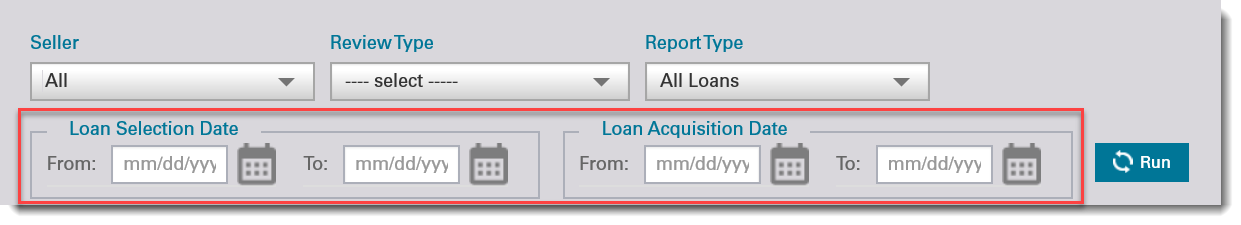

You can refine your custom report by using the date picker to select a range of dates that includes loan selection and/or loan acquisition dates.

-

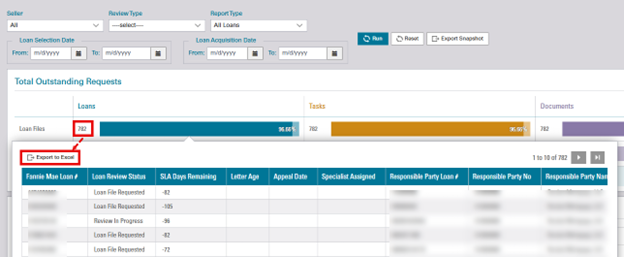

Click Run. The data you requested populates the widgets.

-

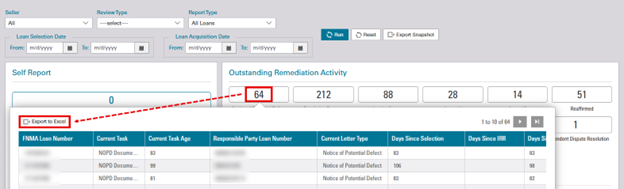

Hover over one of the Total Count numbers to export the data to an Excel spreadsheet.

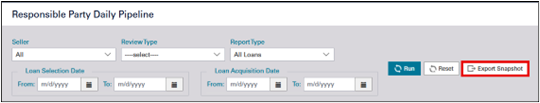

6. NEW Click on Export Snapshot to view and export the overall report in the form of a snapshot image. In this example, we are exporting a snapshot of the Responsible Party Daily Pipeline Report.

Snapshot of the overall report will be displayed as an image.

Seller Dashboard Report

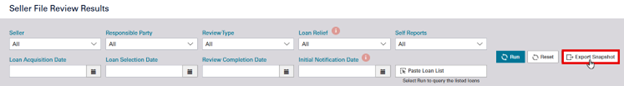

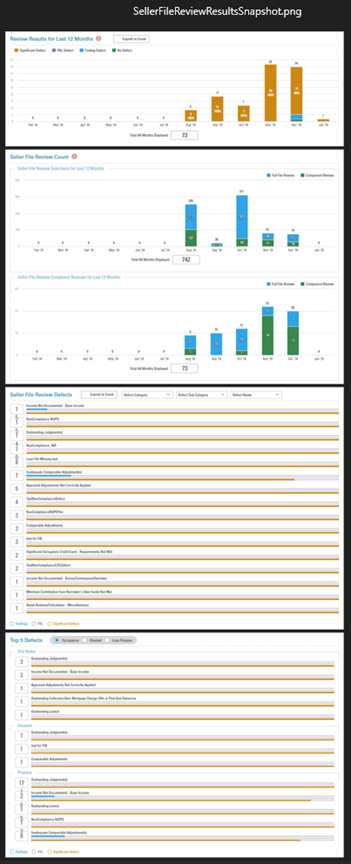

Follow these steps to create a custom seller dashboard report:

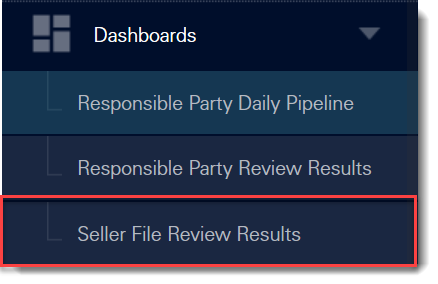

- After logging in to Loan Quality Connect, click Dashboards and select Seller File Review Results.

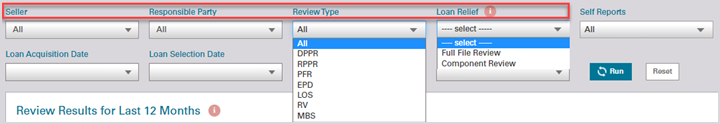

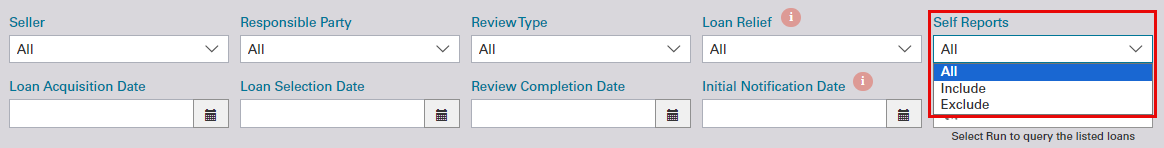

- From the drop-down menus, select the name of your organization (Seller), the Responsible Party, the Report Type, and the Loan Relief.

| Review Types | Report Types |

|

DPPR: Discretionary Post Purchase Review - selections made by a risk-based model that allows for specialized analysis and early loss anticipation/mitigation. RPPR: Random Post-Purchase Review - selections based on random sampling models. PFR: Post Foreclosure Review - selections made after a non-performing loan has been liquidated. EPD: Early Payment Default Review - selections based on delinquency. LOS: Loss Mitigation Review - selections based on loss mitigation activities. RV: Recourse Violations - loans that are subject to recourse provisions. MBS: Mortgage-Backed Securities Review - loans targeted for MBS review. |

Full File Review: eligible for QC Relief. Component Review: not eligible for QC Relief. Self Reports: include or exclude loan files that were self-reported by the lender. |

-

Select whether to include or exclude Self Reports.

-

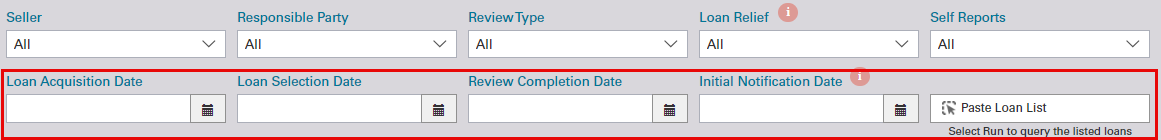

You can refine your custom status report by using the date picker to select a range of dates that includes loan acquisition, loan selection, review completion, and Initial Notification request dates or use the Paste Loan List option to run a query on specific loans.

-

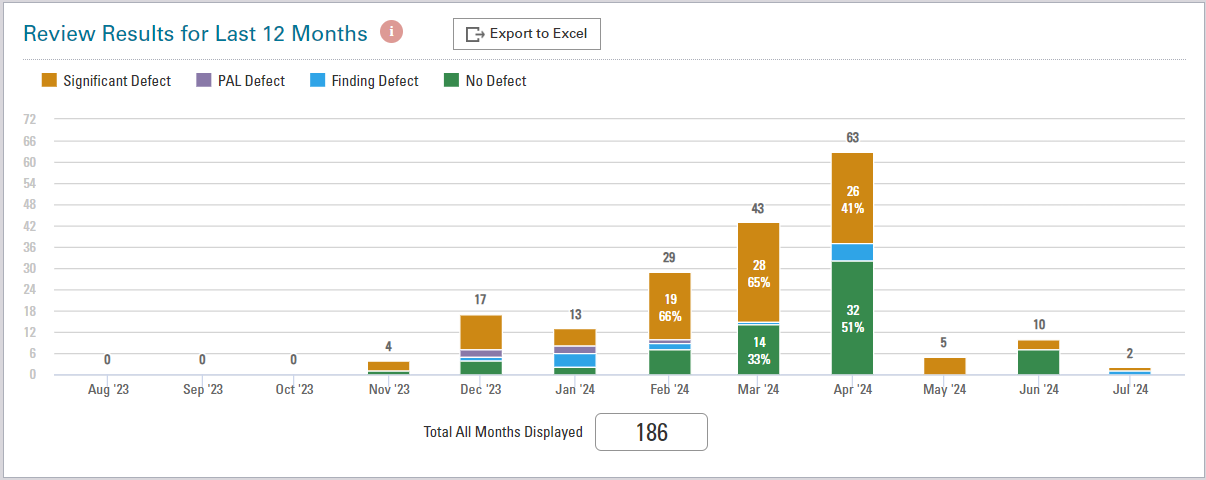

Click Run. The data you requested populates the widgets.

-

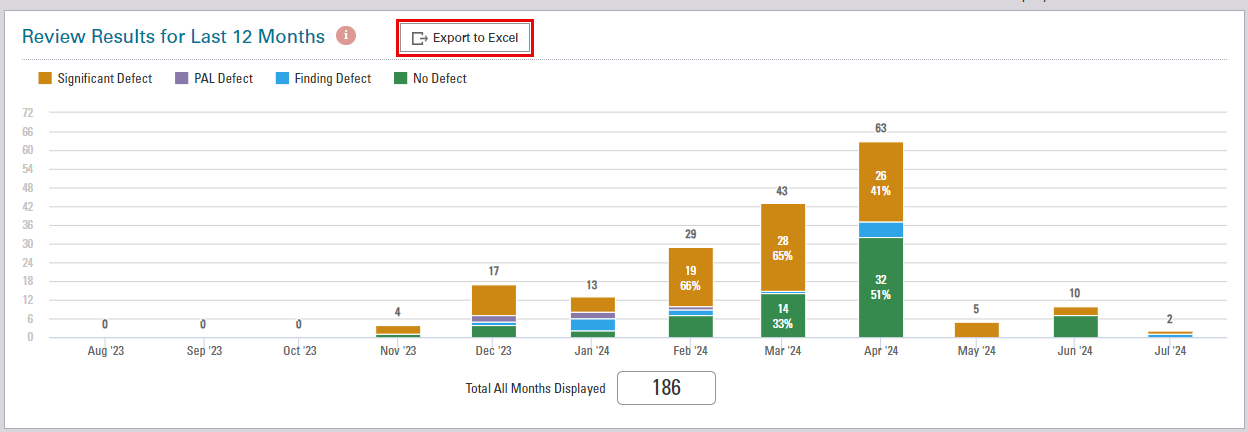

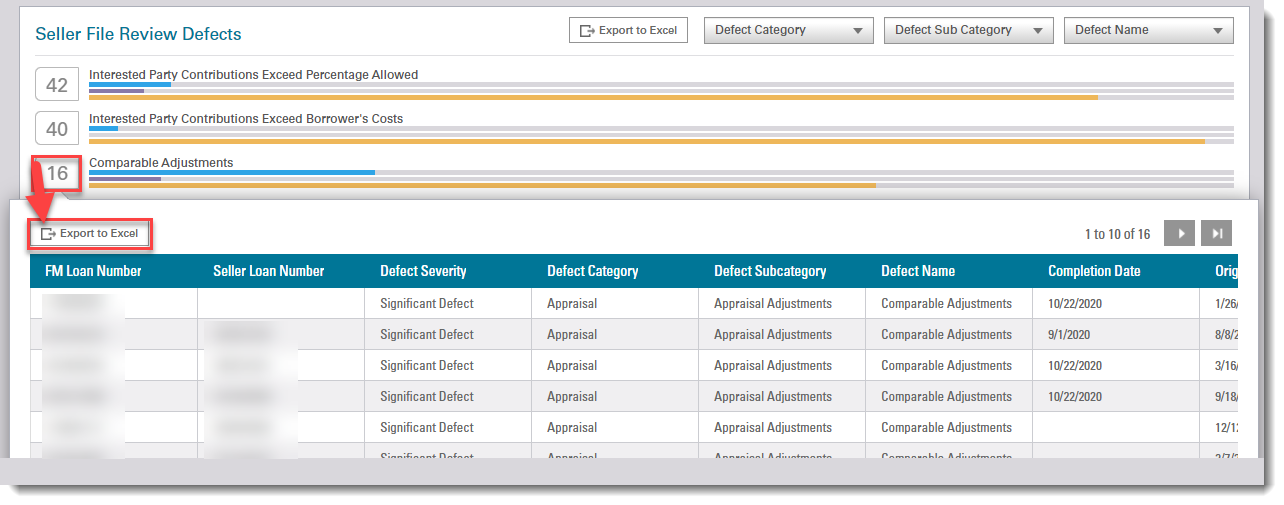

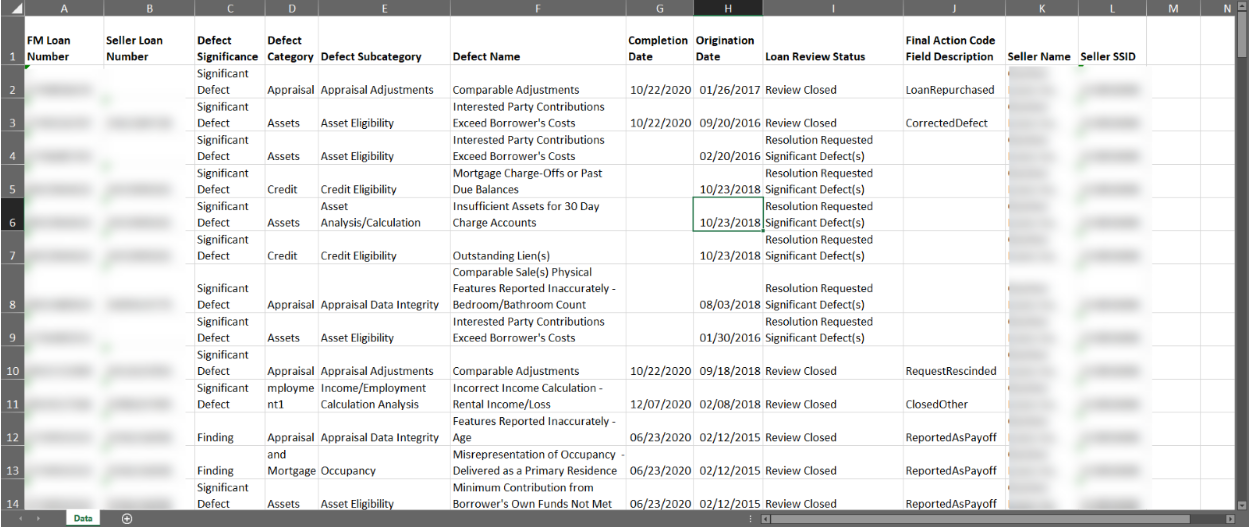

Click the Export to Excel button to export the data to an Excel spreadsheet.

-

Under the Seller File Review Defects, hover over one of the Total Count numbers to export the data to an Excel spreadsheet.

NEW Click on Export Snapshot to view and export overall report in the form of a snapshot image.

Snapshot of the overall report will be displayed as an image.

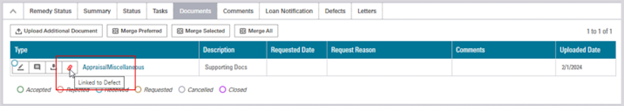

Note: It is not necessary to upload documents that were in the origination file as those documents have already been reviewed. Only Significant Defect(s) need to be addressed by the lender.