My web

Guidelines for Delivering Required Fields for Adjustable Rate Mortgages (ARMs)

![]()

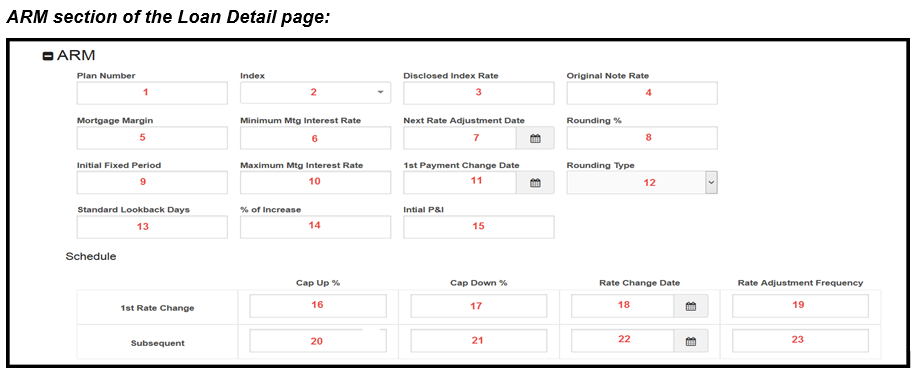

The table below provides a quick reference to the Loan Delivery fields that are applicable to Adjustable Rate Mortgages (ARMs), as well as additional information to assist in delivering the data. Refer to Fannie Mae's Appendix D for details on ARM delivery data.

The following data fields are located in the ARM section in Loan Delivery.

|

Sort ID |

Field # |

Source Location |

Field Name in Loan Delivery |

How to Deliver/Definition |

|

379 |

1 |

Fannie Mae ARM Plan Matrix |

Plan Number |

Enter the Fannie Mae-assigned ARM Plan Number. Refer to the ARM Plan Matrix for further information. |

|

111 |

2 |

Note |

Index |

Enter the Index to be used to determine the interest rate at each adjustment. For import, include SID 110 IndexSourceType = Other. |

|

312 |

3 |

Calculated for Closing Disclosure |

Disclosed Index Rate |

Enter the value of the Index shown in SID 111, used to generate the APR/Closing Disclosure. |

|

321 |

4 |

Note |

Original Note Rate |

Enter the Interest Rate as specified on the Note. The loan’s current interest rate (SID 395) is reported as “Note Rate” in the Loan Terms section of Loan Delivery. If the ARM loan has not adjusted prior to delivery, SIDs 321 and 395 should be the same. |

|

119 |

5 |

Note |

Mortgage Margin |

Enter the Mortgage Margin as specified on the Note. |

|

116 |

6 |

Note |

Minimum Mtg Interest Rate |

Enter the minimum interest rate over the life of the loan as specified on the Note, also known as the interest rate “floor.” (If a minimum interest rate is not indicated on the Note, the margin should be used.) |

|

355 |

7 |

Calculated from Note |

Next Rate Adjustment Date |

Enter the next Interest Rate Adjustment Date based on the delivery date. If the ARM loan has not adjusted prior to delivery, calculate as 1st Payment Change Date (SID 115) minus one month. |

|

117 |

8 |

Note |

Rounding % |

Enter the percentage to which the interest rate is rounded when a new interest rate is calculated as specified on the Note. Used in conjunction with SID 118. Enter 0 if the interest rate is not rounded. |

|

236 |

9 |

Calculated from Note |

Initial Fixed Period |

The number of months that the initial interest rate is in effect. For a one-year ARM, this would be 12. For a 5/1 ARM, this would be 60. Calculate as number of months between First Payment Date (SID 272) and 1st Interest Rate Change Date (SID 115). |

|

114 |

10 |

Note |

Maximum Mtg Interest Rate |

Enter the maximum interest rate over the life of the loan as specified on the Note, also known as the interest rate “ceiling”. |

|

115 |

11 |

Note |

1st Payment Change Date |

Enter the First Payment Change Date as specified on the Note. |

|

118 |

12 |

Note |

Rounding Type |

Enter how the interest rate is rounded when a new interest rate is calculated. Used in conjunction with SID 117. |

|

113 |

13 |

Note |

Standard Lookback Days |

Enter the number of days to count back from the interest rate change date to determine the applicable index value to use for establishing the new interest rate. |

|

131 |

14 |

n/a |

% of Increase |

Leave Blank; applies to Growing Equity Mortgage Type, which Fannie Mae no longer purchases. For import, do not report SID 126 AdjustmentRuleType. |

|

268 |

15 |

Note |

Initial P&I |

The dollar amount of the principal and interest payment as stated on the Note. The loan’s current principal and interest payment amount (SID 436) is reported as “P&I” in the Loan Terms section of Loan Delivery. If the ARM loan has not adjusted prior to delivery, SIDs 268 and 426 should be the same. |

|

122 |

16 |

Note |

Cap Up % |

First adjustment: Enter the maximum number of percentage points by which the interest rate can increase from the original interest rate as specified on the Note. |

|

121 |

17 |

Note |

Cap Down % |

First adjustment: Enter the maximum number of percentage points by which the interest rate can decrease from the original interest rate as specified on the Note. For import, include SID 120 AdjustmentRuleType = First. |

|

123 |

18 |

Calculated from Note |

Rate Change Date |

First adjustment: Enter the First Interest Rate Change Date. For import, include SID 120 AdjustmentRuleType = First. Calculate as 1st Payment Change Date SID 115 minus one month. |

|

124 |

19 |

Calculated from Note |

Rate Adjustment Frequency |

First adjustment: Enter the Number of months the interest rate will be in effect at the First Rate Change Date. Do not enter the Initial Fixed Period. For all Fannie Mae published ARM Plans (except 760 and 761), this should be 12. For ARM Plans 760 and 761, this should be 6. For import, include SID 120 AdjustmentRuleType = First. |

|

122 |

20 |

Note |

Cap Up % |

Subsequent adjustment: Enter the maximum number of percentage points by which the interest rate can increase from the previous interest rate as specified on the Note. For import, include SID 120 AdjustmentRuleType = Subsequent. |

|

121 |

21 |

Note |

Cap Down % |

Subsequent adjustment: Enter the maximum number of percentage points by which the interest rate can decrease from the previous interest rate as specified on the Note. For import, include SID 120 AdjustmentRuleType = Subsequent. |

|

123 |

22 |

Calculated from Note |

Rate Change Date |

Subsequent adjustment: Enter the Second-Rate Change Date. For import, include SID 120 AdjustmentRuleType = Subsequent. Calculate as SID 115 minus one month. Calculate as First Adjustment Rate Change Date from SID 123 (Field #18) plus number of months from Initial Fixed Period SID 236. |

|

124 |

23 |

Calculated from Note |

Rate Adjustment Frequency |

Subsequent adjustment: Enter the Number of months the interest rates will be in effect at the Subsequent Rate Change dates. For all Fannie Mae published ARM Plans (except 760 and 761), this should be 12. For ARM Plans 760 and 761, this should be 6. For import, include SID 120 AdjustmentRuleType = Subsequent. |

NOTE: Refer to "ARMs Note Rate Example" in left-hand navigation panel for an example of where data might be found on the Adjustable Rate Note.

NOTE: Refer to "Most Frequently Used ARMs" in left-hand navigation panel for an example of how to populate ARM data in Loan Delivery for common standard ARM loan programs.