My web

Importing and Viewing Results ULAD MISMO 3.4 files

![]()

ULAD MISMO 3.4 Files

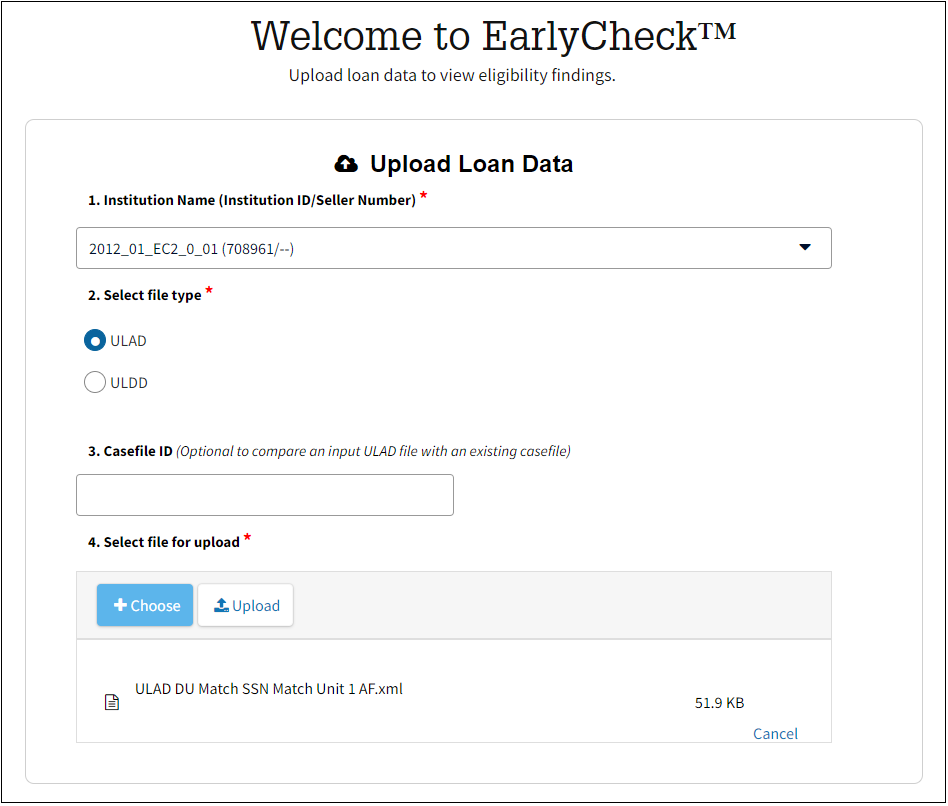

If you are uploading Uniform Loan Application Dataset (ULAD) files follow the steps below:

- Select the appropriate Institution Name from the Institution Name (Institution ID/Seller Number) drop down list.

Note: If your institution name is not available in the drop down box you may use any that is available or contact your Fannie Mae representative to have it added.

- Select the ULAD radio button.

Note: You have the option to add Casefile ID if it is not included in the import file.

- Click + Choose and select appropriate ULAD file.

Result: The ULAD file will appear in the box below the + Choose and Upload buttons.

- Click Upload.

Note: Click Cancel to delete the attached file.

ULAD EarlyCheck™ Loan Level Results

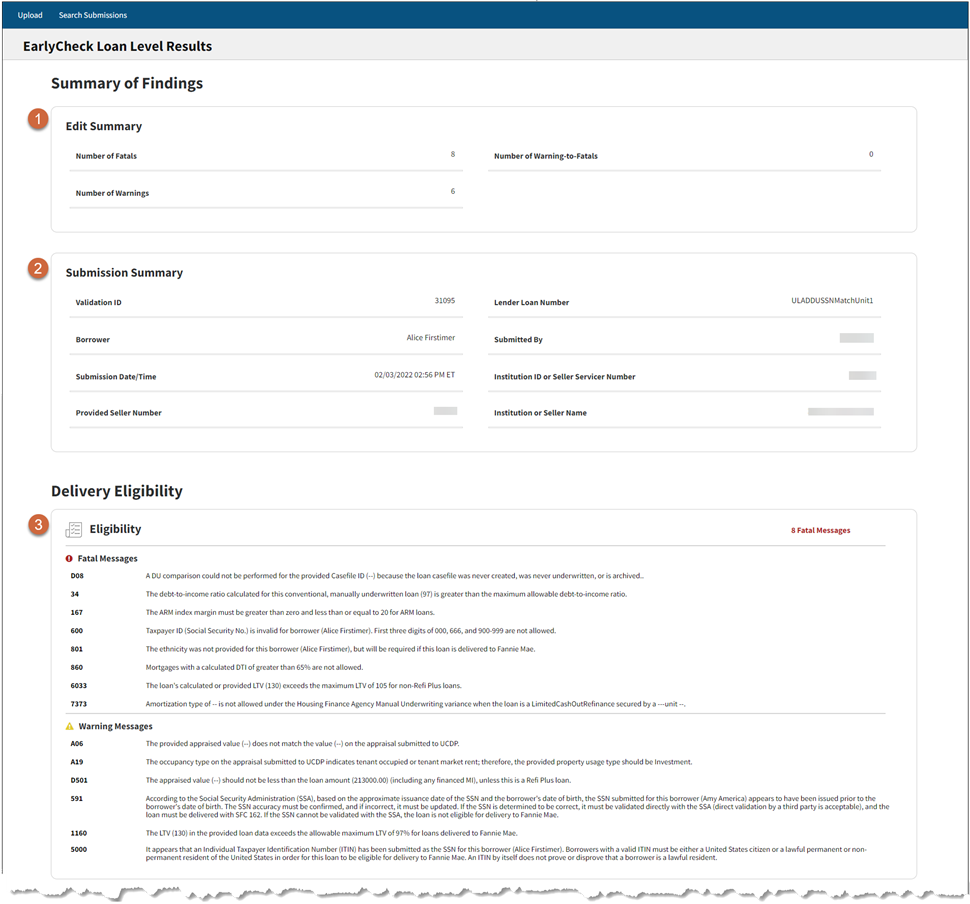

| EarlyCheck Loan Level Results Screen (per loan) | ||

| 1 | Edit Summary | Displays an overall breakdown of the edits returned by EarlyCheck, including number of Fatal, Warning-to-Fatal, and Warnings. |

| 2 | Submission Summary |

Displays loan's Validation ID, the date and time the loan file was submitted to EarlyCheck , and other information. Note: The Validation ID is a system generated numeric ID assigned to each EarlyCheck loan submission. If a loan is submitted to EarlyCheck more than once, a new Validation ID is created for each loan submission. Note: If the load time exceeds the set timeout period the following message will appear, "Your request is being processed. This may take a moment. You may return to the results list under Search Submissions page and continue working while you are waiting for processing to complete." |

| 3 |

Eligibility (All possible eligibility message types are listed) |

Displays eligibility messages.

|

Note: If there are loans with fatal edits, correct those loans per Eligibility Fatal Messages and resubmit. You cannot edit loan data in EarlyCheck. If needed, make changes to loan data in the loan origination system (LOS) used to generate the loan file and import and check the loan file within EarlyCheck again.

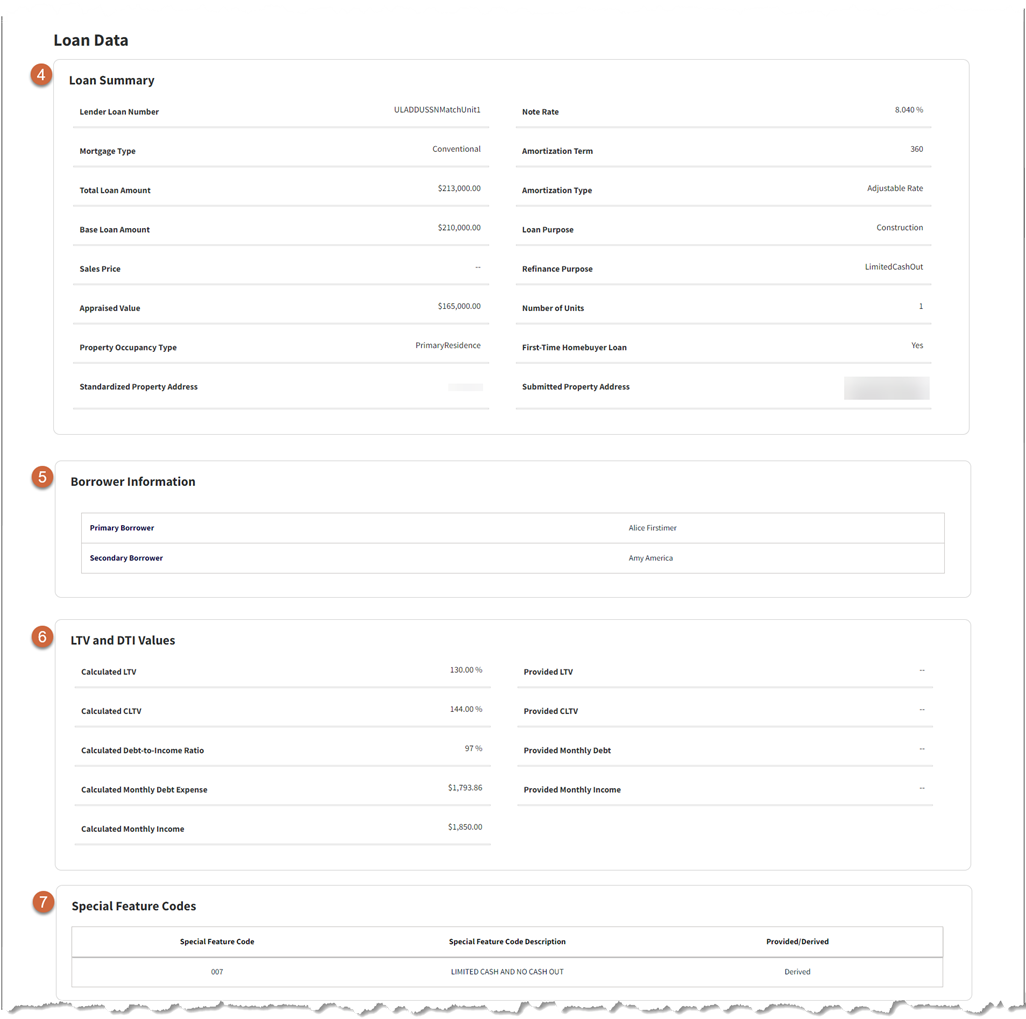

| 4 | Loan Summary | Displays general loan data information. |

| 5 | Borrower Information | Displays general borrower information. |

| 6 | Loan-to-Value (LTV) and Debt-to-Income (DTI) Values | Displays general LTV and DTI value information. |

| 7 | Special Feature Codes (SFCs) | Displays applicable SFCs. |

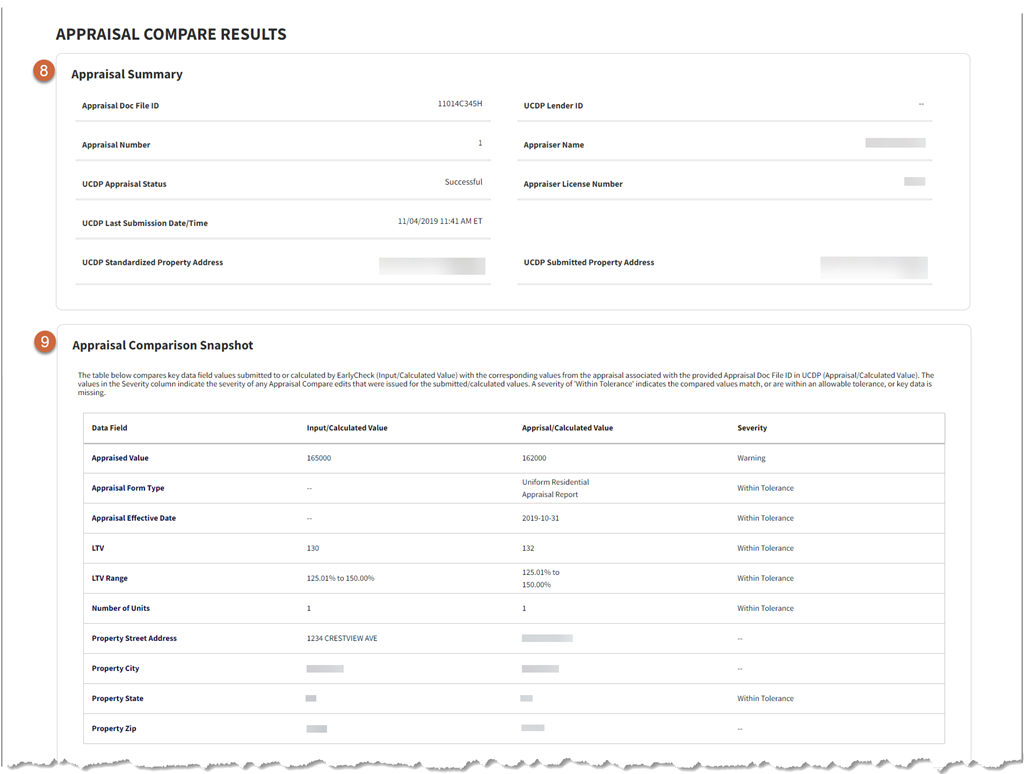

| 8 | Appraisal Summary | Displays key information about the appraisal, such as appraisal Doc File ID, appraisal number (i.e., the appraisal selected for comparison if multiple appraisals are associated with the appraisal Doc File ID in Uniform Collateral Data Portal (UCDP)), appraisal submission status from UCDP, UCDP last submission date and time, appraiser information, and property address. |

| 9 | Appraisal Comparison Snapshot | Displays a table that compares key data values submitted to or calculated by EarlyCheck with the corresponding values from the appraisal associated with the submitted Doc File ID in UCDP. The table includes a column indicating the severity of any appraisal comparison edits issued for the submitted or calculated values. A severity of 'Within Tolerance' indicates the compared values match or are within an allowable tolerance. If the values do not match or are outside the allowable tolerance, the severity of the edit will be displayed. All appraisal comparison edits are informational. |

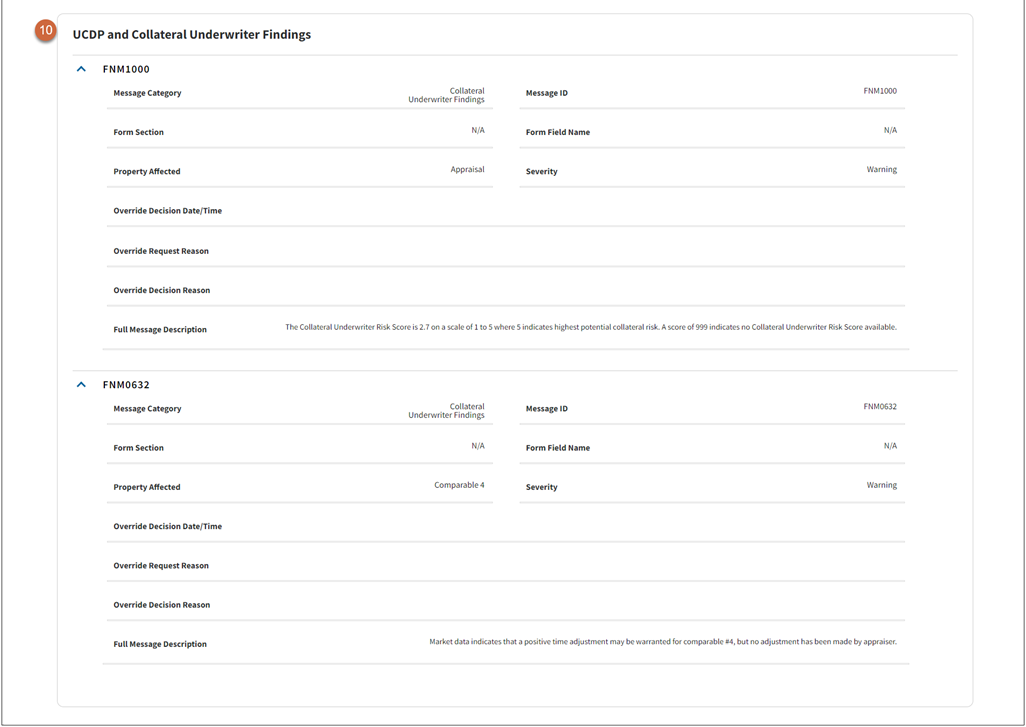

| 10 | Uniform Collateral Data Portal (UCDP) and Collateral Underwriter® (CU®) Findings | Displays a table that lists the UCDP and CU hard stop and findings messages issued for the appraisal associated with the submitted Doc File ID. The messages displayed in this section are the same messages displayed in the Fannie Mae Submission Summary Report (SSR) for the associated appraisal. |

Note: For information on UCDP and Collateral Underwriter messages, including eLearning courses and FAQs, refer to the Collateral Underwriter® and Uniform Collateral Data Portal (UCDP) webpages on the Fannie Mae business portal.

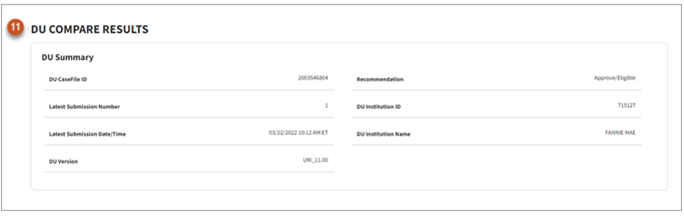

| 11 | Desktop Underwriter® (DU®) Compare Results |

The DU Compare, compares key data from the imported loan file with the latest submission of the loan casefile in DU. Note: This feature exists for conventional DU loans only. To obtain DU Compare results, the following are required:

You may compare your loan data to the DU loan casefile submitted by another institution if the DU casefile ID and the borrower's SSN in the provided loan data matches the data in the DU casefile. The DU Summary portion includes key summary information about the latest submission to DU, including the DU Underwriting Recommendation, the latest submission number, the time and date of the latest submission, and the DU version used for underwriting. |

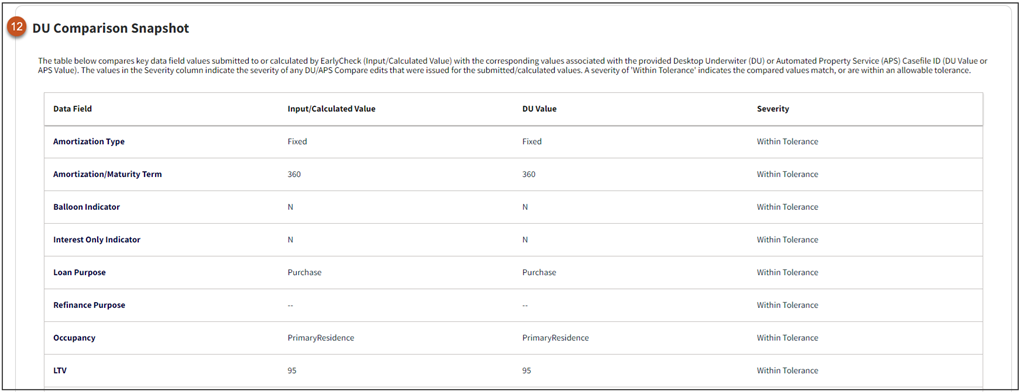

| 12 | DU Comparison Snapshot |

The DU Comparison Snapshot provides a side-by-side comparison of the key data elements from the imported loan file versus the casefile in DU, as well as the severity of any data discrepancy. The list is sorted by severity so that you can easily pinpoint the discrepancies that need to be addressed. Below is a description of the possible severity levels:

|

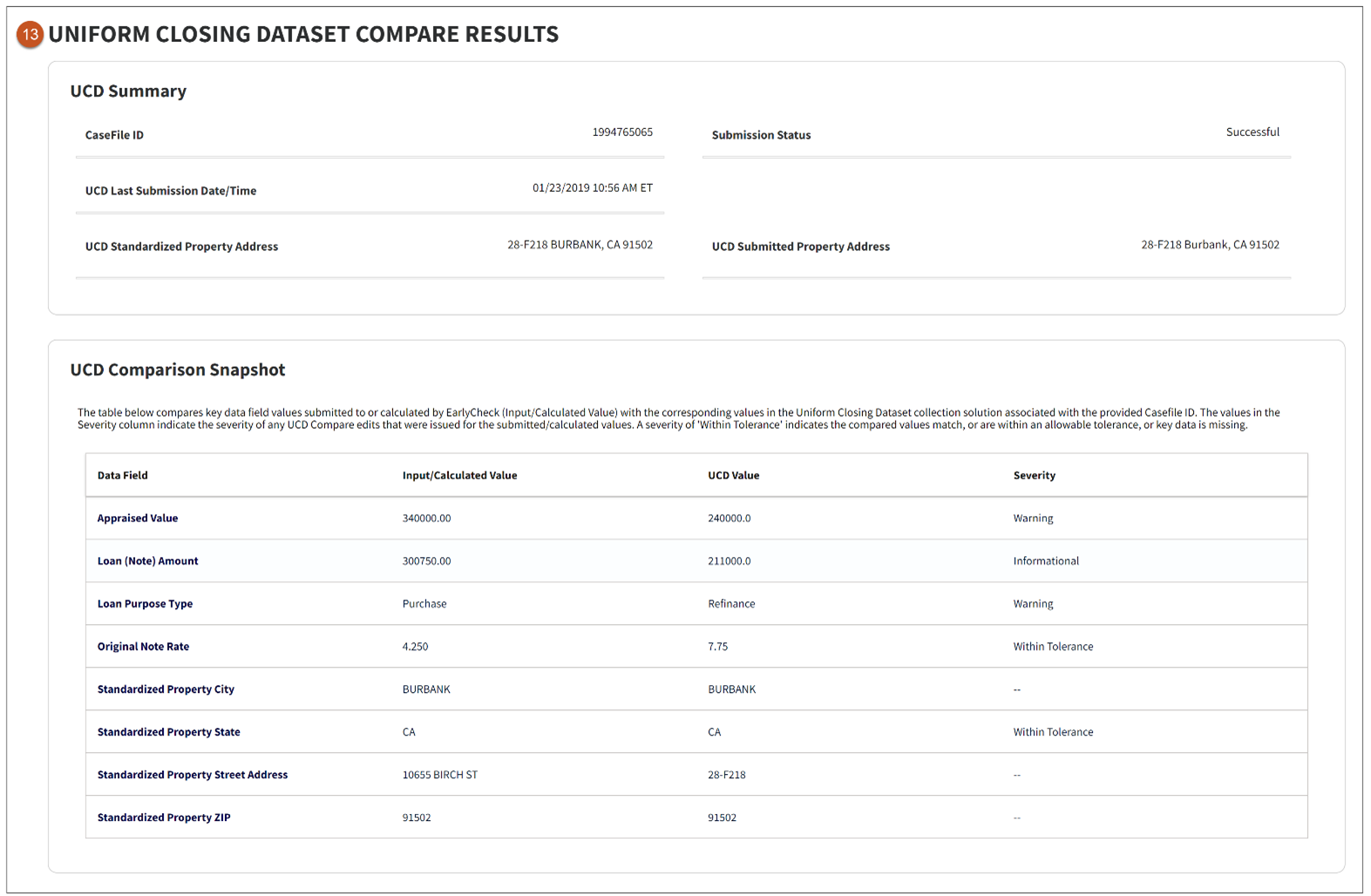

| 13 | The Uniform Closing Dataset (UCD) Compare Results |

The Uniform Closing Dataset (UCD) Compare Results section displays when a UCD match is performed on the submitted casefile ID. The section includes two categories of information:

|